Securing housing loans for foreigners in Singapore: 2026 Guide

This article covers:

- Key takeaways

- Who is considered a foreigner in Singapore?

- What types of properties can foreigners buy in Singapore?

- Are foreigners eligible for housing loans in Singapore?

- How much can foreigners borrow?

- How to apply for a home loan as a foreigner in Singapore

- More information about home loans for foreigners in Singapore

- Final thoughts on housing loan

- FAQs

Key takeaways

-

Foreigners are classified into two groups: permanent residents (PRs) and non-PRs. Those who have obtained their PRs for at least 3 years can buy resale HDB flats, while non-PRs are not eligible for HDB housing.

-

Both PRs and non-PRs must pay Additional Buyer’s Stamp Duty (ABSD) even if it’s their first time buying a house. The rate starts from 5% for PRs and is 60% for non-PR foreigners.

-

Foreigners are eligible for housing loans, as long as they meet the requirements, such as holding an Employment Pass (EP), earning a stable income, and presenting a strong credit history, among others.

-

The maximum amount foreigners can borrow is determined by Loan-to-Value (LTV) and Total Debt Servicing Ratio (TDSR).

-

Each financing institution has its own regulations as to how much it can lend, which prompts you to do thorough research to find which offers the most valuable mortgage package.

Thinking of making Singapore your long-term home? Whether it’s a new job opportunity or a lifestyle upgrade, many expats start off renting. As your needs evolve or your family grows, buying a property might be the smarter move.

However, there are certain regulations that apply to foreigners when it comes to buying properties. As a foreigner, your choices are limited. For example, you can’t purchase an HDB unit meant for Singapore citizens and permanent residents. You also need to pay extra fees such as the Additional Buyer’s Stamp Duty (ABSD), which is significantly higher for foreigners.

Given these circumstances, it’s entirely your decision whether to rent or buy a property. If you decide to purchase a home, we are here to guide you on how to secure housing loans for foreigners in Singapore.

Who is considered a foreigner in Singapore?

Before we continue discussing foreigners’ eligibility to buy properties in Singapore, let’s make it clear who is considered a foreigner here.

According to the Singapore Land Authority, you are considered a foreigner if you’re:

-

Not a Singapore citizen

-

Not a Singapore company

-

Not a Singapore limited liability partnership

-

Not a Singapore association

Singapore permanent residents (PRs), in this case, are considered foreigners. We’ll dive into this matter later in the next section.

What types of properties can foreigners buy in Singapore?

Before buying property in Singapore, it’s important to understand what you’re eligible to purchase. The rules differ depending on whether you’re a Singapore Permanent Resident (PR) or a foreigner without PR status.

|

Property Type |

PRs |

Non-PRs |

|

New HDB Flats (BTO) |

No |

No |

|

Resale HDB Flats |

Yes* |

No |

|

Executive Condominiums (New) |

No |

No |

|

Executive Condominiums (Resale >5 years) |

Yes |

Yes |

|

Condominiums & Private Apartments |

Yes |

Yes |

|

Strata Landed House |

Yes** |

Yes** |

|

Landed House in Sentosa Cove |

Yes** |

Yes** |

|

Commercial Properties |

Yes |

Yes |

Notes:

*Must be PRs for at least 3 years and buy a resale HDB unit with a Singapore citizen or PR.

**Must first acquire government approval.

Under government regulations, foreigners must obtain approval from the Singapore Land Authority’s Land Dealings Approval Unit (LDAU) before purchasing landed properties.

Approval is assessed on a case-by-case basis by the Singapore Land Authority (SLA). Key factors include your economic contribution to Singapore, with a stronger chance of approval if you’ve been a Singapore Permanent Resident (PR) for at least five years.

Approval is assessed on a case-by-case basis by the Singapore Land Authority (SLA). Key criteria include making a significant economic contribution to Singapore. Being a Singapore permanent resident (PR) for at least five years improves the chances of approval.

However, an exception applies to foreigners looking to purchase landed properties in the exclusive Sentosa Cove area. Approvals can be granted within two days, but the property must be owner-occupied. Renting out the property can result in a $200,000 fine and three years of imprisonment.

Are foreigners eligible for housing loans in Singapore?

Property in Singapore doesn’t come cheap. The median price stands at around 1.3 million SGD. So, unless you’re loaded with cash, bank loan is the most accessible way for your housing purchase.

And yes, foreigners are eligible for bank loans in Singapore. Those with the following qualifications are more likely to secure approval for your home loan:

Hold a permanent residency

Banks often prefer borrowers who are financially stable and committed to staying in the country for the long term to avoid the risk of housing loan default. Thus, being a PR can increase the likelihood of mortgage approval, as this shows your financial commitment and long-term presence in Singapore.

Holding a permanent residency also gives you access to certain property types, such as resale HDB flats. This is an advantage on your side, as it widens your financing options for home loans in Singapore.

Hold an employment pass (EP)

Getting an Employment Pass (EP) is not an easy process. By holding an EP, which shows you’re a high-earning professional, with a verified source of income in Singapore, which banks consider more creditworthy for a housing loan.

You have to earn a minimum salary of 5,600 SGD, among other qualifications.

Is a Singapore bank account holder

Having a local bank account helps facilitate your transactions and loan repayments to the lending bank. The lending bank can also track your financial history, cash flow, and savings more straightforwardly, increasing your chances of securing a house mortgage.

Strong credit history

Creditworthiness is a key factor in getting your housing loan approved, so if you plan to buy a home in Singapore, it’s important to build a strong local credit history. Even if you have good credit in your home country, it doesn’t automatically transfer.

To strengthen your credit in Singapore, consider getting a Singapore-issued credit card and using it responsibly by paying the full balance each month. Over time, this helps you build a solid credit profile, making it easier to qualify for a housing loan as a foreigner.

As your credit history grows, it becomes easier to secure your home loan as a foreigner in Singapore.

Significant economic contribution

Contributing significantly to the country’s economy, such as through investments, entrepreneurship, and innovation, will go a long way.

However, having this qualification can increase your loan approval chances for any other eligible properties you prefer, such as resale executive condominiums, private condominiums, and private apartments.

How much can foreigners borrow?

There are two factors that determine how much a foreigner can borrow for home loans, namely Loan-To-Value (LTV) and Total Debt Servicing Ratio (TDSR). We’ll help you understand them below:

Loan-To-Value (LTV) Ratio

The Loan-to-Value (LTV) ratio determines how much of a property’s price can be financed with a mortgage. If you’re taking a housing loan for the first time, you can borrow up to 75% of the property’s value.

However, if you already have one existing home loan, the maximum loan amount drops to 45%, and if you have two or more home loans, it is further reduced to 35%.

Example:

You’re planning to buy a $1 million condominium and want to finance it with loans.

-

As a first-time borrower, you’re eligible for up to 75% financing. The bank may lend you $750,000, and the remaining 25% or $250,000 should be paid in cash as a down payment.

-

If you have another existing home loan, the LTV decreases to 45%. This means the bank can lend you $450,000, and you have to pay a higher down payment, or $550,000 as a down payment.

-

If you have two or more existing home loans, the LTV is further capped at 35%. The bank can lend you $350,000, and $650,000 should go to a down payment.

Total Debt Servicing Ratio (TDSR)

TDSR limits how much of your income can go to loans, including housing loans. The cap is 55% of your gross monthly income.

Example:

You’re a working professional with a $12,000 gross monthly income, and you’re planning to buy a $1 million condominium with loans.

-

With no existing loan (applies to car, personal and other types of loans), you can borrow $6,600 per month that goes to housing loan repayment ($12,000 x 55%).

-

With an existing loan, let’s say $3000 per month for a car loan, your remaining allowable loan repayment for a housing loan would be $3,600 ($12,000 × 55% – $3,000). This reduces the total amount you can borrow for your home.

How to apply for a home loan as a foreigner in Singapore

Now that you’ve understood the basics of property ownership and chosen the home you’d like to buy, the next step is securing a home loan. Here’s a quick overview of the application process:

As you have grasped the basics of property ownership and decided on the home to buy, here comes the application process you need to know. The steps are as follows:

1. Check your eligibility

The Singapore government has certain regulations on foreigners’ property ownership. Make sure to know which types of property you’re eligible to buy, along with the financial requirements you have to meet (i.e., earning a stable salary, having a strong credit history, and having enough cash for a down payment)

Also, consider the take note of the Additional Buyer’s Stamp Duty (ABSD) that applies to PR and non-PR foreigners. The rates vary from 5 – 60% of the property value. You must pay this tax on top of the mandatory Buyer’s Stamp Duty (BSD) with a ranging rate from 1 – 6%, depending on the property’s value and type (residential or non-residential).

2. Determine loan amount

Calculate the amount of loan you’re eligible for. Use the Loan-To-Value to determine how much of the property’s value can be financed with a loan (up to 75% if you’re a first-time borrower, and lower for subsequent house loans).

Following that, use the TDSR to determine how much loan you’re eligible for based on your monthly gross income (capped at 55%).

Additionally, you need to factor in mortgage interest rates. Different banks will have varying rates and packages, which can impact your total repayment amount.

Lastly, a longer loan tenure lowers your monthly payments but increases the total interest you’ll pay over time. For example, if you take a 5-year loan, your monthly payments will be higher, but you’ll pay less interest overall, whereas a 10-year loan will have lower monthly payments but cost more in total interest.

3. Compare mortgage offers

Different banks have different mortgage offers. Alternatively, check in with mortgage specialists to see what would be better home loan packages for yourself.

Consider these factors before landing on one lending entity:

-

Interest rates: Some banks offer fixed interest rates, while others offer floating interest rates. Compare them carefully to ensure you get the most favourable interest rates.

-

Lock-in period: This is the minimum period you’re required to stay with your housing lender before you can refinance your loan with another provider—without incurring penalties. It refers to a timeframe you’re obligated to remain with the housing lender before refinancing to other parties. The lock-in period typically ranges from 1 – 5 years, depending on the lender’s policies.

-

Eligibility criteria: While the general eligibility requirements for foreigners securing home loans in Singapore are clear, each bank may have its own minimum income level and credit score requirements, among other factors.

-

Special promotion: Look out for deals offered by lending banks, such as cashback programmes or waived processing fees, to reduce your overall loan costs.

4. Submit loan applications

To secure your home loan as a foreigner in Singapore, there are several documents you need to prepare, including:

-

Personal identification documents: These include a copy of your passport, PR card (if any), and Employment Pass.

-

Proof of income and employment: Prepare a copy of 6 months’ payslips, employment contract, Notice of Assessment, and other relevant documents.

-

Proof of financial standing: These include six months’ bank statements, credit reports, and other supporting documents.

-

Property-related documents: These include an Option to Purchase (OTP) or Sale & Purchase Agreement and a copy of the property valuation report.

Please note that the specific lending bank may ask for additional documents depending on their requirements. If you’re unsure, you can reach out to the bank directly for a detailed checklist.

5. Sign the agreement

Once you’ve submitted your loan application, it should take anywhere between a few days and a couple of weeks for approval.

Once your home loan is approved, you will be prompted to sign the agreement. Make sure that you read the clauses thoroughly, focusing on loan terms, interest rates, lock-in period and other relevant information.

Always ask the lender for clarification on any terms before signing.

6. Complete housing purchase

After signing the agreement, the next thing to do is complete your housing purchase by paying a down payment and other fees.

Expect to pay at least 25% of the property value as a down payment, given that the maximum Loan-to-Value (LTV) is 75% of the house’s price.

You should also prepare funds for other fees, such as Buyer’s Stamp Duty (BSD), Additional Buyer’s Stamp Duty (ABSD), and mortgage closing costs.

Since these payments can be significant, and you may need to transfer funds from overseas, using a reliable international large transfer service can help streamline the process. It allows you to move large sums of money securely and cost-effectively, avoiding the high fees and unnecessary delays of a traditional bank.

More information about home loans for foreigners in Singapore

Property tax for foreigners

Foreigners in Singapore face higher property taxes than citizens. While Singaporeans pay Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD) only on their second and subsequent homes, foreigners must pay both BSD and ABSD on every property purchase—including their first.

Foreigners in Singapore face higher property taxes than citizens. While Singapore citizens only need to pay Buyer’s Stamp Duty (BSD) and incur Additional Buyer’s Stamp Duty (ABSD) on second and subsequent properties, foreigners are required to pay both BSD and ABSD regardless of whether it’s their first or additional home purchase.

Here’s a breakdown of ABSD rates for Singapore PRs, which are lower than those for non-PR foreigners:

|

Buyer’s Profile |

ABSD Rates |

|

PR buying first residential property |

5% |

|

PR buying second residential property |

30% |

|

PR buying third and subsequent residential property |

35% |

|

Foreigners buying any residential property |

60% |

However, an exemption applies to nationals from countries that signed a Free Trade Agreement (FTA) with Singapore, including the United States, Switzerland, Iceland, Norway, and Liechtenstein. They’re treated the same as Singapore citizens and will not pay ABSD on their first home purchase—this tax only applies to second and subsequent property purchases.

Different types of house mortgage interest rates

There are two types of house mortgage interest rates: fixed-rate and floating-rate interest. How do they differ, and which to choose?

Fixed Interest Rates

A fixed-rate interest remains constant for a set period. Each financial institution has different terms. Some may give 1 – 5 years, while others may offer fixed terms of up to 10 years.

This option offers greater stability and peace of mind, though it also means you could end up paying higher interest when market rates decrease during your fixed term.

Floating Interest Rates

A floating-rate interest fluctuates based on the market trends. If market rates decrease, so does your loan interest, which can lower your monthly loan repayment.

However, with this option, budgeting can be unpredictable. While it can seem attractive during periods of low interest rates, you could end up paying more when market rates increase over time.

Home loans refinancing

Refinancing your home loan is a strategic move to help reduce interest costs, lower monthly repayments, or adjust loan tenure to better suit your financial situation.

The process can be complex; however, discussing it with a mortgage specialist can help you untangle the various loan options, fees, and potential savings.

Note that you may also need to engage a lawyer to handle the legal aspects of the refinancing process. But don’t worry about finding a lawyer to manage the paperwork and ensure compliance. Most banks typically provide a list of approved legal panels for loan documentation and property conveyancing.

Final thoughts on housing loan

As a foreigner, you have to adhere to Singapore’s property ownership regulations and meet certain criteria before buying a house here. Unless you’re a Singapore PR or a nation of countries that signed the Free Trade Agreement (FTA) with Singapore, you’re also faced with high property tax, also known as the ABSD, which is 60% of the property value.

It’s undeniably expensive, indeed. But securing your home loan as a foreigner in Singapore is always possible. Financing your home with a loan can help manage upfront costs and ease your financial burden.

Throughout the process, you’ll need to transfer large sums for your down payment, taxes, and other fees. However, using a traditional bank for international transfers can be costly due to high processing fees and less competitive exchange rates.

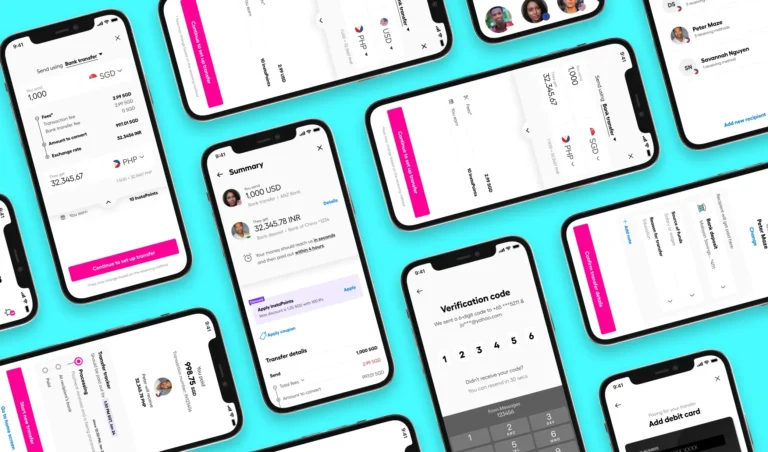

Save more with Instarem to make large money transfers. Our fees are as low as 0.5% of the transfer amount, and we offer favourable exchange rates, giving you more value for money!

Wonder how it works? Here’s how to send large amounts of money securely using Instarem:

-

Create your free account

-

Add a recipient

-

Enter the amount to transfer

-

Verify your international money transfer

Make your large transfer a breeze. Start with Instarem today!

FAQs

Can a foreigner get a home loan in Singapore?

Yes, a foreigner can get a home loan in Singapore. Here are the requirements to meet:

- Holding a permanent residency/Employment Pass (EP)

-

Earning a stable income

-

Have a strong credit history

-

Paying 60% of Additional Buyer’s Stamp Duty (ABSD)—applies to non-PR foreigners who are not nations of the FTA countries

How much can a foreigner loan in Singapore?

The amount of housing loan that a foreigner can borrow in Singapore is determined by Loan-to-Value (LTV) and Total Debt Servicing Ratio (TDSR), capped at 75% and 55%, respectively.

Can non-Singaporeans buy HDB?

No, foreigners do not qualify for HDB flat eligibility. HDB is a public housing scheme that is strictly reserved for Singapore citizens and permanent residents under specific eligibility conditions.

How long does the mortgage approval process take?

The mortgage approval process varies, depending on the completeness of submitted documents and the policies of the financial institution involved. But it usually takes anywhere between a few days and a couple of weeks.