This article covers:

You know you’re adulting when payday becomes the highlight of your month. But then, before you know it, it’s gone in a flash. So, what’s the solution? Saving money, obviously! But, like, how exactly?

Does it mean you stop spending altogether and just bask in the sun to save? Nah, we’re not about that. After all, all work and no play makes Jack a dull boy.

So, how do we find that balance? Don’t worry, we’ve got you covered in this blog. We’ll keep it simple and straightforward.

Identify your saving goals

Let’s talk about saving goals. It might seem weird, right? Aren’t we supposed to save just to spend eventually? Well, yeah, but having that stash of cash gives you freedom to reach your goals.

So, what exactly are saving goals? Here are some examples.

Emergency Fund

What if something unexpected happens? Like, what if a family member gets sick or your house catches fire? Bad stuff happens when you least expect it, and being prepared can make a tough situation a bit easier. Having money saved up means you can handle emergencies without freaking out.

Buying a Home

Renting? Nah, owning your own place is where it’s at. There’s something about having your own spot that just feels right. You feel more rooted, less at the mercy of a landlord’s whims or the uncertainty of lease changes.

Sure, owning a home comes with its own set of challenges, but you can’t beat the stability it brings.

Plus, think about it: housing prices tend to go up over time. That place you buy now for $150,000? It could easily double in value in 20 years. Rent, on the other hand, is money down the drain.

Education Fund

Are you all about learning? Whether it’s books, top-notch teachers, or a fancy school, education costs money. And if you’re serious about chasing your dreams, you’ll need to save up.

Travel and Fun Fund

Whether it’s a quick trip to the mall or a big adventure around the globe, having savings means you can kick back, relax, and enjoy life to the max.

Retirement Fund

You’ve probably heard about this one before. We all dream of retiring and living the good life without worrying about money. But before you get to the beach and start sipping juice, you got to think about your health and finances.

As we get older, our bodies get creakier, job opportunities shrink, and retirement looms closer. Save smart now, and you’ll have the freedom to make the best decisions when you’re kicking back in your golden years.

How to build your savings?

So, once you’ve got your goal in mind, it’s time to figure out how to make it happen. Here’s the lowdown:

- Pay yourself first: Take 10% of your pay check and stash it away in savings. Set up automatic transfers so you don’t even have to think about it.

- Start with the 50/30/20 rule: Divvy up your income so 50% goes to necessities, 30% to fun stuff, and 20% to savings.

- Nail down your essentials: Make a list of what you absolutely need to spend money on. If it’s a want, just say no. Then set up your pay check to go straight into savings, with a little extra padding for good measure.

- Stick to your budget: Practice self-control when you’re out shopping. Do your research, stick to your budget, and always get the best bang for your buck.

- Keep tabs on your spending: Track every penny you spend so you know where your money is going. Use apps to help you stay on top of it all.

- Set your priorities: Figure out what matters the most to you and focus your efforts there.

- Pick the right tools: Choose the savings options that match your goals, whether it’s a simple savings account or diving into the stock market.

- Boost your income: Look for ways to bring in extra cash to keep up with rising costs.

- Make it a game: Set savings goals and challenge yourself to crush them ahead of schedule.

- Every penny counts: Don’t underestimate the power of small savings. Those little bits add up fast!

What are the top barriers to the habit?

So, what are the main roadblocks to getting into the saving groove? Well, saving is a solid habit to have, but let’s face it, it’s not exactly a walk in the park. Why? Because money is everywhere in our lives, tempting us to splurge and treat ourselves at every turn.

Here are a few hurdles you might encounter:

- Lacking Discipline: If you’re not disciplined with your spending, saving is going to be tough. Whether you’re a careless spender or just forgetful about saving, discipline is key. Luckily, there are tools out there to help you stay on track.

- Drowning in Debt: Borrowing a bit here and there might seem harmless, but it can seriously cramp your saving style. Any money you manage to save will likely end up going towards paying off debt first. So, if financial freedom is your goal, focus on becoming debt-free.

- Brand Obsession: Social media’s got everyone flaunting their flashy lifestyles, making it easy to get caught up in the allure of fancy brands. But splurging on designer goods won’t get you any closer to your financial goals.

- Lack of Purpose: Sometimes, it feels like we don’t really need to save right now. But guess what? Life’s full of surprises, and having a safety net for unexpected challenges is crucial. Whether it’s your kid’s education, your parents’ health, or a big-ticket item like a car or house, having a specific goal in mind can keep you motivated to save.

Embracing change: The path to financial freedom

So, here’s the deal: building saving habits boils down to discipline and playing the long game. Rome wasn’t built in a day, and neither is your savings stash. It’s easy to get tempted and think, “I’ll just dip into my savings this once and pay it back later.” But trust us, that’s a slippery slope.

You won’t see the results of your hard work if you don’t give it time to grow. And you won’t fully appreciate the importance of saving until you really need it.

So, don’t let life call the shots when it comes to your money goals. Take charge and stay ahead of the game.

Before you go…

You know, everyone talks about the importance of saving up, but not everyone’s clued in on the best way to actually do it, especially if you’re living the expat life and juggling different currencies.

Sure, you could go the traditional route and send money to your savings account, but let us tell you, there’s a smarter way to go about it.

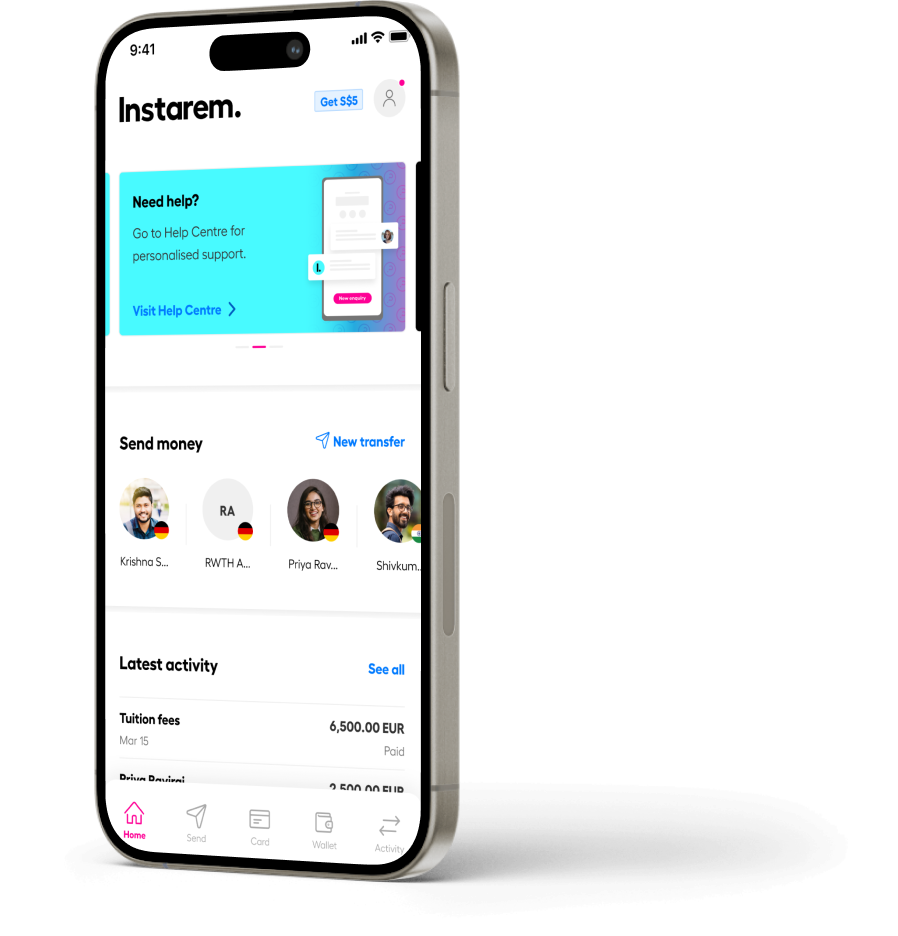

Enter Instarem. We make international money transfers a breeze with lightning-fast transfers, minimal fees, and great exchange rates.

We’ve got your back when it comes to sending money to over 60 countries. So, if you’re after a hassle-free and affordable way to beef up your savings back home, Instarem’s got you covered.

Our user-friendly platform lets you send money with just a few clicks, and with our competitive rates and low fees, you’ll be getting the most bang for your buck.

Try Instarem for your next transfer.

Download the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.