Wise vs Revolut: Which to choose? [2026 Review]

This article covers:

- Wise and Revolut: An overview

- Wise vs Revolut: Rating comparison

- Wise vs Revolut: Main features of financial services

- Wise vs Revolut: Pricing structure

- Wise vs Revolut: Exchange rates when you transfer money

- Wise vs Revolut: Supported countries

- Wise vs Revolut: Global reach

- Wise vs Revolut: Customer support team

- Wise vs Revolut: Pros and Cons

- Final Thoughts: Who’s the winner for cross border money transfer?

- Frequently asked questions

Both originating from the UK, Wise and Revolut have become popular platforms for getting money moving. Many have switched from traditional banks to using them for global payments, transactions, and everything bank services-related.

Though both offer excellent services, determining the best between Wise vs Revolut requires several considerations. You’ll need to know which provides greater flexibility, lower fees, more favourable exchange rates, the list goes on.

That’s why we’re here to compare Wise and Revolut, so that you can land on one that best suits your needs.

Read on to learn more.

Wise and Revolut: An overview

Going through an overview of Wise and Revolut helps you to gain a glimpse into their company profiles. This further allows you to assess which one provides the best services catering to your needs.

Wise UK

Wise, previously TransferWise, is a fintech company specialising in remittance that was founded in London, UK. It’s an easy-to-use platform, equipped with intuitive features for cross-border transfers to 160+ countries in 40+ currencies.

What people love most about Wise is its low fees and zero exchange rate markups. So the profit is entirely derived from transfer fees, which start from 0.33% and may increase depending on the currency involved and when payments are made with debit/credit cards.

Realising that people have different needs when it comes to using a remittance service, Wise launched their global expansion plan with three different products: Wise Account, Wise Business, and Wise Platform. This way, Wise can remain to be the top-of-mind choice, whatever the type of transaction is.

It is no longer a start up and is currently listed on London stock exchange.

Revolut

Founded in London, UK, Revolut has evolved from a start up to a neobank, providing a broad range of banking services. With Revolut, not only are users able to make global payments to 160+ countries in 70+ currencies, but they can also enjoy features like cryptocurrency exchange, joint accounts, saving vaults, and more.

Its versatility isn’t the only factor that makes Revolut a preferred payment platform. Users can also benefit from its competitive pricing structure, as they can make fee-free payments up to a certain limit with no additional exchange rate surcharges during market hours.

And there’s more of Revolut as personal users can choose between plans, sign up to Revolut Business to accommodate business needs or register to Revolut <18 designed for minors who need guardians.

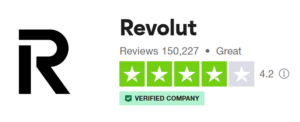

Wise vs Revolut: Rating comparison

Wise and Revolut have the same ratings on Trustpilot. This shows they’re equal opponents, and you may need to look past the ratings to decide which one is best for you.

Wise Rating

Revolut Rating

Wise vs Revolut: Main features of financial services

Given the tie in Wise vs Revolut’s ratings, comparing the main features they provide can help you decide which is best for you.

Let’s take a look at them in the following:

Wise account features

Designed as a cross-border payment solution, Wise’s features are tailored to facilitate ease of transactions, whether it’s for sending and receiving money or paying in countries around the world. With this goal in mind, users are provided with the following features:

Wise money transfer

Ever since Wise was still known by its TransferWise moniker, money transfer has been its mainstay feature. This feature allows users to make direct payments to 160+ countries in 40+ currencies at a affordable price and reliable speed.

The fees incurred are significantly lower than when using traditional banks. You’ll only be charged around from 0.33% of transfer fees –subject to changes if you’re sending to less popular currencies or using card payments– and no hidden fees on exchange rate markups.

Additionally, the time it takes for the money to be delivered to the recipient is reliable. For some currencies, you may even choose fast transfer for more immediate delivery. However, choosing this option will incur higher transfer fees on your end.

Account details

Despite being popular for its direct bank transfers, Wise also supports in-app money receiving via its account details feature. Using account details, users can receive money in 12 currencies, including AUD, CAD, EUR, GBP, NZD, MYR, PLN, SGD, USD, RON, HUF, and TRY.

Multicurrency account

As Wise progresses beyond just sending or receiving money, it’s now providing a multicurrency account feature. With this feature, you can store money in 40+ currencies to send to others or convert between currencies in seconds.

This is especially beneficial if you frequently use a certain foreign money. You can leave behind the hassles of exchanging money in banks or physical money changers, which often charge higher, less transparent fees.

Direct Debit

Paying bills on time can be a mundane task that we frequently overlook. This is why Wise offers a direct debit capability, in which users agree to allow service providers to withdraw their Wise balances when the payments are due.

Wise Cards

The fact that overseas transactions aren’t just about sending or receiving money, Wise comes with its Wise Cards –available in physical and digital forms. Using Wise Cards, users are allowed to spend money abroad with online or offline merchants and withdraw cash overseas at more competitive exchange rates.

Part of the process of using Wise Cards involves topping up the balance, which incurs small transaction fees. Users can then use the cards without incurring any additional fees as they’ve been charged previously.

Jars

Wise comes with its jars feature that allows users to set aside their budget for certain necessities, such as bills, emergency funds, digital subscriptions, and more.

(Optional) Wise platform for Business

The features mentioned beforehand are designed for Wise Personal accounts. In cases where users need more advanced, enterprise-friendly payment features, the UK company has them covered with Wise Business.

Wise Business users have access to the same features as Wise Personal. The difference is that Wise Business enables account holders to make batch payments to up to 1,000 accounts, grants team members access to physical and digital cards, pays invoices, integrates Wise with accounting software, and much more.

Revolut’s features

Unlike Wise, which focuses on affordable international transfers, Revolut app caters to wider finance needs, with its main strength lying in its multicurrency cards. But this does not exclude other features, which are explained below:

Revolut Card

Being the main feature offered by the London company, Revolut cards provide ease of transactions when travelling abroad. Users can choose between the available plans –Standard, Plus, Premium, Metal, and Ultra– and spend in overseas merchants or withdraw cash more affordably.

Not only can users save more on exchange rates when you pay abroad, but they’re also eligible for extra benefits that vary depending on the chosen plan. These include travel insurance, airport lounge access, accommodation cashback, and more.

So when it comes to comparing the Wise card vs Revolut card, the first offers more savings to use abroad, while the latter gives more convenience and extra benefits tailored to travel needs.

International transfer

Given that overseas transfers have become the norm, Revolut offers a seamless international transfer feature. This feature allows users to send money to 160+ countries in 70+ currencies with a few clicks.

The transfers made are also fee-free up to a certain amount per month. Only after exceeding the limit are users charged between 0.5% to 1% of the fair usage fee. But this highly depends on the chosen plan, as higher-tier plans have no fair usage fee, allowing users to make fee-free transfers without limits.

Payments

Almost everything has transitioned to digital, and this includes the payments we make every day. With Revolut, users can easily make and receive payments via chat, split the bills seamlessly, and send extra special money gifts to loved ones.

However, this feature is only available for use between Revolut users. This means that payments to unregistered users can only be made via international transfer.

Joint Account

Sharing income for daily necessities is made easier with Revolut’s joint account feature. This feature allows users to easily contribute to a shared balance with their partner, friend, or parent while also tracking their spending together.

Users may also obtain a physical card linked to their joint account, enhancing the convenience of daily spending for shared needs.

Saving vault

Aside from the versatile payment cards, Revolut also makes an attractive platform due to its saving vault feature. With this feature, users can save their money in 30+ currencies and earn up to 4% interest rates.

Investment portfolio

Earning more out of your money is made possible with Revolut’s investment portfolio feature. Choose between the instruments that suit you best, whether it’s cryptocurrencies, stocks, or commodities.

Multicurrency account (Available on Revolut business account)

With more and more businesses operating in more than one country, Revolut provides a multicurrency account that Revolut Business users can use. This feature enables users to divide expenses incurred in multiple currencies, resulting in enhanced transparency.

Though it’s only available for Revolut Business accounts, Revolut Personal users also have access to similar multicurrency capabilities. Unlike Wise, Revolut encourages users to store their multi currency balances in Revolut cards, which they can then use in the same way Wise does.

Wise vs Revolut: Pricing structure

When it comes to pricing structure, there are differences to highlight between Wise and Revolut. Wise, claiming to be a low-cost international payment platform, prioritises competitive exchange rates and transparent fees. Revolut may or may not incur higher fees, depending on how you use it.

We’ll break down their pricing structures below:

Wise

Opening a Wise account is free, and the transfer fees start as low as 0.33% of the total value. Other factors, like the destination currency or payment method, may influence the fees. They’re likely to be higher when the currency is less popular or when users pay with cards.

For ATM withdrawals using Wise cards, users are entitled to 2 fee-free withdrawals per calendar month. Wise will charge fixed and variable fees on the 3rd withdrawal onwards, depending on the amount and currency withdrawn.

Nonetheless, Wise is always transparent about its pricing structure. Check fees for sending money overseas, as well as the Wise card pricing scheme, to find out how much fees are charged to make international transfers or to cash abroad.

Revolut

Though using Revolut can be as affordable as using Wise, it has more variables that affect its pricing structure. What are those? We’ll explain below:

Plans

Revolut has a total of 5 plans for its customers: Standard, Plus, Premium, Metal, and Ultra. Out of which, four are paid plans.

Each plan incurs different fees for services, currency conversion, international transfers, and ATM withdrawals.

| Standard | Plus | Premium | Metal | Ultra |

Service Fee | Free | £3.99/month | £7.99/month | £14.99/month | £55/month |

International transfers | Fee-free for the first £1,000 limit per month. Once the limit has been reached, a fair usage fee will apply. | Fee-free for the first £3,000 limit per month. Once the limit has been reached, a fair usage fee will apply. | No fair usage fee. | No fair usage fee. | No fair usage fee. |

ATM withdrawals | Fee-free for £200 or 5 withdrawals. A 2% fee applies when the limit has been reached. | Fee-free for £200 withdrawals. A 2% fee applies when the limit has been reached. | Fee-free for £400 withdrawal. A 2% fee applies when the limit has been reached. | Fee-free for £800 withdrawal per month. A 2% fee applies when the limit has been reached. | Fee-free for £2,000 withdrawal per month. A 2% fee applies when the limit has been reached. |

Transaction time

Aside from the fees associated with the chosen plan, Revolut charges an additional 0.5% to 1% exchange fee for currency conversion made outside of market hours or during the weekends. This surcharge applies regardless of whether you have reached the fee-free limit or not.

Wise vs Revolut: Exchange rates when you transfer money

When it comes to sending money overseas, both Wise and Revolut have their FX rate structures. Wonder which is more favourable? Take a look at the breakdown below:

Wise

When it comes to exchanging foreign currency, Wise uses mid-market exchange rates, anytime customers transact, and without hidden markups. This means the only way they profit is through their transfer fees, making it a platform for budget-conscious users.

More interestingly, Wise locks in the rates for the next 48 hours after customers make their transactions. This capability ensures the recipient receives the same amount as sent by the sender, even when there’s any delay, as long as it remains within the 48-hour window.

Revolut

Similar to Wise, Revolut also uses interbank rates when foreign currencies are involved. This means they impose no hidden markups on the exchange rates, as long as the transactions are made within the market hours.

Transactions made after market hours or over the weekends, on the other hand, will incur a 1% surcharge. This is why customers are advised to make payments during market hours or to schedule payments to avoid additional fees.

Wise vs Revolut: Supported countries

After considering the features, fees, and exchange rates, have you settled on either Wise or Revolut? Wait a minute, you still need to confirm whether or not your preferred global payment platform supports your country.

A list of countries supported by Wise for currency exchange

Wise supports customers in almost every country around the world. However, an exception applies to certain countries where users can’t open or log in to Wise accounts. The countries include:

Afghanistan

Belarus

Burundi

Central African Republic

Chad

Congo

Democratic Republic of the Congo

Cuba

Region of Crimea

Eritrea

Iran

Iraq

North Korea

Libya

Myanmar

Somalia

Republic of South Sudan

Russia

Sudan

Syria

Yemen

Venezuela

Ukraine regions: Donetsk, Luhansk, Kherson, Zaporizhzhia

A list of countries supported by Revolut

Revolut’s global coverage is quite extensive, making financial management and international transfers convenient for users from the following countries:

Belgium

Bulgaria

Czechia

Denmark

Cyprus

Latvia

Lithuania

Luxembourg

Spain

France

Croatia

Italy

Poland

Romania

Slovenia

Hungary

Malta

Netherlands

Austria

Iceland

Liechtenstein

Norway

Slovakia

Finland

Sweden

Germany

Estonia

Ireland

Greece

Australia

New Zealand

Singapore

Japan

Brazil

Switzerland

United Kingdom

United States of America

Wise vs Revolut: Global reach

In addition to considering whether or not your country is supported by Wise or Revolut, another thing to think about is their global reach. This is especially important if you need to send money to less popular nations or currencies.

Wise’s global reach

Wise supports international transfers to 160+ countries in 40+ currencies. Even if the country you intend to send to isn’t on the list, you can still make payments in GBP, EUR, or USD.

Revolut’s global reach

As a payment solution catering to wider finance needs, Revolut also supports overseas payments to 160+ countries in 70+ currencies. This means you can send it almost anywhere around the globe.

However, an exception applies to certain nations, including:

Afghanistan

Algeria

Angola

Belarus

Burkina Faso

Burundi

Cambodia

Central African Republic

Congo

Democratic Republic of the Congo

Crimea

Cuba

Côte d’Ivoire

Egypt

Eritrea

Guinea

Guinea-Bissau

Guyana

Haiti

Iran

Iraq

North Korea

Laos

Lebanon

Libya

Myanmar

Nigeria

Pakistan

Palestinian Territory (Occupied)

Panama

Russian Federation

Sierra Leone

Somalia

South Sudan

Sudan

Swaziland

Syrian Arab Republic, Trinidad and Tobago

Tunisia

Uganda

Vanuatu

Venezuela

Yemen

Zimbabwe

Ukrainian Territory: Luhansk, Donetsk, Zaporizhzhia, and Kherson

Wise vs Revolut: Customer support team

When you’re manage your own money, things don’t always go perfectly. If you hit a snag, knowing how to reach customer support quickly makes all the difference. So here’s how you can get help from Wise and Revolut.

With Wise, you can log in via the website or app and head to Contact us to reach customer support through chat or email. If you’re having trouble logging in, you can still access support through the Wise Help Centre on their website and select Contact us from there.

For Revolut, customer support is mainly available through the in-app chat, where you’ll get fast, personalised help in over 100 languages. Can’t log in? You can still reach Revolut by emailing their support team at [email protected].

Wise vs Revolut: Pros and Cons

Just like life, nothing is perfect, neither is Wise nor Revolut. With their excellence, some downsides or risk that come along. Your task now is to decide which option has the benefits you’re looking for in a payment solution.

Wise

Pros:

Affordable transfers: Transferring money overseas with Wise is affordable as you’ll only be charged starting from 0.33% of the transfer value.

Widely supported among nations around the globe: You can sign up and start making transactions with Wise from almost anywhere in the world.

No exchange rate markups: Sending money to overseas incurs no exchange rate markups, as Wise uses mid-market rates anytime you transact.

Cons:

Fewer nations to send money to: Compared to Revolut, Wise has less reach of countries you can send money to.

Has limited in-app features: As it focuses on providing afforable transfers, Wise’s in-app features are mainly designed to send, receive, or store money.

Fewer benefits on Wise Cards: Wise cards are designed to help users save on exchange rates without offering further benefits.

Revolut

Pros:

Fee-free payments up to a certain limit: Sending money with Revolut is affordable, and even free if the amount stays below the monthly limit.

Broader reach: Revolut supports transfers to 160+ countries in 70+ currencies.

More benefits from using the cards: Aside from allowing users to save on exchange rates, Revolut gives added benefits from using the cards, such as travel insurance, airport lounge access, accommodation cashback, and more.

Cons:

Exchange rate surcharges during the after-hours: Making transactions with Revolut outside of the market hours or during the weekends incurs an additional 1% exchange rate surcharge.

Some plans incur monthly fees: Certain plans offered by Revolut incur monthly fees that start from £3.99/month to £55/month.

Higher fees on larger transfers: Despite offering fee-free transfers up to a certain limit, the fees can go even higher than Wise’s once you’ve reached the limit.

Final Thoughts: Who’s the winner for cross border money transfer?

Deciding on the winner between Wise and Revolut is entirely personal. One may benefit from the low-cost and no exchange rate markups offered by Wise and others may be looking for a more versatile finance management app like Revolut.

So it’s beyond our scope to determine which UK company is the winner. But if you ask for an alternative, we’d gladly introduce you to Instarem.

Instarem is a noteworthy global payment platform that eases the process of sending and receiving money in multiple currencies. The fees are also affordable, much lower than those of traditional banks, making it a top choice for cost-conscious individuals.

![]()

Wonder how Instarem works? Experience the convenience by yourself! Create an account and sign up today!

Frequently asked questions

Is Wise better than Revolut?

Wise may or may not be better than Revolut, as it highly depends on what you’re looking for in a payment solution. If you’re looking for a low-cost platform, then Wise is the right fit. Otherwise, if you need more versatile capabilities, then you may consider Revolut instead.

Revolut versus Wise, which one is more affordable?

When it comes to affordability, Wise wins. This is because its fees are low and consistent, with no exchange rate markups applied regardless of market hours.

Does Wise have a UK banking licence?

Wise is not a licensed bank, so it doesn’t operate like a traditional Uk bank account for deposit-taking or lending institution. Instead, it offers digital banking services under an Electronic Money Institution (EMI) licence in Europe, allowing customers to hold multiple currencies in one account, get local account details in 8+ currencies, send and receive domestic and international payments, set up direct debits, spend with a linked debit card, and earn interest on GBP, EUR, and USD.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products.