QuickBooks vs Xero: Which Accounting Software is Best for Your Business?

This article covers:

Key Takeaways

Feature | Xero | QuickBooks |

Target Audience | Small to medium-sized businesses seeking a user-friendly platform | Small to large businesses requiring advanced features and customisation |

Ease of Use | Highly intuitive, with a clean interface | Can be complex, especially for beginners |

Invoicing | Strong invoicing features, including online payments and mobile access | Comprehensive invoicing options, including progress invoicing and time-tracking integration |

Expense Tracking | Efficient receipt capture and expense claim management | Strong expense tracking with tax categorisation and receipt capture |

Payroll Management | Suitable for small businesses, with basic payroll features | Comprehensive payroll management with tax penalty protection and automation |

Pricing | Generally more affordable, with unlimited users on all plans | Offers a wider range of plans with varying feature sets and pricing |

Pros | Cloud-based, intuitive, affordable, unlimited users | Comprehensive features, advanced customisation, tax penalty protection |

Cons | Limited inventory management, missing debt collection tool, feature restrictions in lower tiers | A steep learning curve, expensive for higher tiers, limited scalability |

Running a small business, freelancing or launching a startup is incredibly rewarding. There’s nothing quite like seeing your ideas come to life, being a boss, having more flexible hours and reaping the full benefits of your hard work.

But let’s be honest—it’s not all sunshine and rainbows. You don’t have the security of being an employee. How do you bring enough money just to keep the lights on? What’s it like to feel the weight of your employees’ financial well-being?

And perhaps the most challenging part is managing the financial side. Tracking expenses, generating invoices, making accounting reports and calculating taxes while trying to grow your business is no easy feat.

This is where accounting software comes into play. Xero and QuickBooks are the two leading options in the market, each with features to help manage finances efficiently. But how do you select the best accounting software for your specific needs?

In this accounting software comparison blog, we’ll cover Xero vs QuickBooks. What are their key features, pricing, ease of use, pros and cons that make them different? Let’s start.

QuickBooks and Xero: An Overview

Before we dive into a comprehensive comparison of QuickBooks and Xero, let’s first look at their history.

What is QuickBooks?

Developed by Intuit by Scott Cook and Tom Proulx, a company founded in the early 1980s, QuickBooks was inspired by personal finance software. It was designed to provide small businesses with user-friendly yet structured financial management tools.

However, during the 1990s and early 2000s, QuickBooks faced challenges expanding internationally due to several shortcomings. Accounting professionals criticised its lack of security features, audit trails and compliance with traditional accounting standards.

To fix these problems, Intuit enhanced QuickBooks’ record-keeping and key functionalities. They also made it harder for people to steal information.

Now, the platform offers many features and financial tools to help small businesses manage their money.

For example, businesses can easily manage employee paychecks, track inventory levels, send invoices and accept payments through digital channels. Additionally, the platform provides options for professional bookkeeping services and time tracking.

QuickBooks also offers flexible subscription options for monthly or yearly billing. Regardless of your chosen plan, you’ll get features tailored to your business type.

What is Xero?

Xero was born from the partnership of two New Zealanders: Rod Drury, a tech entrepreneur, and Hamish Edwards, an experienced accountant. Together, they identified a common challenge faced by many small business owners—the struggle to manage finances without the same tools and resources available to larger companies.

As of writing, Xero has more than 4.2 million subscribers in 180 countries. It can also be integrated with over 1,000 third-party apps.

Just like QuickBooks, its success wasn’t instant. Xero faced tough competition from big companies like Intuit, which already dominated the accounting software market.

It was hard to convince people to invest in or use Xero because it was a new company. On top of that, Xero had to solve many technical problems, like ensuring their software worked with different accounting systems and understanding complicated tax rules in countries.

But Xero has long since evolved and grown since its inception. It has a complete set of accounting tools, including features for tracking money coming in and going out, managing bills and invoices, following spending and keeping tabs on inventory.

Xero also lets you assign different levels of access with user roles like Limited, Standard or Administrator to people in your business. This means you can decide who can see and do what within the software.

<h2> Comparing Features: QuickBooks vs Xero

To help you decide which platform best suits your needs, let’s further explore the features of Xero and QuickBooks:

Xero vs QuickBooks: Invoicing

An invoice is a formal bill that lists the goods or services a customer has bought and the total amount they owe. It’s a request for payment for work completed or products delivered.

Luckily, both Xero and QuickBooks offer invoicing features to help businesses manage their sales and payments effectively.

However, there are key differences in their approach and capabilities.

Xero Invoicing

Like other accounting software, Xero allows you to personalise invoices with your company logo and other branding elements. You can quickly convert estimates into invoices and send them out.

Xero also integrates with popular payment platforms including PayPal, Stripe or Square, enabling customers to pay online directly from the invoice. For added convenience, you can create invoices on the go using the Xero mobile app.

Other invoicing features include:

- Your invoice drafts are automatically saved, preventing lost work.

- Approve and email invoices with a single click.

- Apply discounts as percentages or fixed amounts.

- Set credit limits for customers to manage potential bad debt.

QuickBooks Invoicing

QuickBooks’ invoicing capabilities are considered among the top-rated features in the accounting software industry. Some of its features include:

- You can create and send invoices effortlessly from your computer or smartphone.

- Accept payments directly through QuickBooks or popular payment platforms like PayPal or Square.

- Easily convert estimates into invoices.

- Save time with recurring invoices and automatic payment reminders.

- With QuickBooks Time, you can seamlessly integrate billable hours into your invoices.

It also offers progress invoicing, which lets you break down large projects into smaller, invoiceable stages. This feature allows you to bill clients as you complete project milestones. The system will record payments made for each project across different invoices.

Xero vs QuickBooks: Expense Tracking

By keeping close tabs on your business spending, you can quickly spot and control unnecessary costs. Understanding your cash flow is important for identifying areas where money might be wasted. This is why regular expense tracking helps prevent financial problems before they become serious.

Here’s a comparison of expense tracking between Xero and QuickBooks:

Xero Expense Tracking

Xero allows you to snap photos of your receipts and automatically matches them to transactions, making it easy to track and manage expenses.

Your employees can also quickly submit expense claims by simply taking a photo of their receipt with the app. This prompt claim submission can lead to faster reimbursement for your employees, boosting morale and reducing clutter.

Moreover, Xero helps you keep tabs on what your team is spending. Get a clear picture of your expenses and when you need to pay people back to manage your cash flow.

- Stay on top of expense claims with up-to-the-minute reports.

- See patterns in your spending to plan ahead.

- Use real-time numbers to predict costs and create budgets.

QuickBooks Expense Tracking

Like Xero, QuickBooks also provides receipt capture using the QuickBooks mobile app. You can keep them organised and ready to match with your bank statements when it’s tax time.

What makes the expense tracking features of the platform ideal for businesses is they help you prepare when filing taxes. Effortlessly monitor your business expenses throughout the year to ensure you never overlook a tax deduction. QuickBooks customises tax categories for your business and tracks sales tax rates.

You can choose from commonly used tax rates or add your own, and QuickBooks will automatically manage the sales tax for you.

Xero vs QuickBooks: Payroll Management

Managing payroll can be complex and risky, involving everything from handling sensitive employee data to calculating taxes and ensuring accurate deposits into employee bank accounts.

Let’s break down the key differences between Xero and QuickBooks in payroll management.

Xero Payroll Management

Xero allows you to calculate employee pay, including deductions and taxes. It helps users manage a small workforce and maintain accurate payroll records. You can reuse previous pay runs as a template and make necessary adjustments. Also, the system generates payslips directly from Xero and sends them electronically or prints them out.

With Xero, you can maintain employee pay records with:

- Storing pay run information online and easily reconciling wage payments.

- Employee pay records and bank account details are securely stored online

- Easily track and verify salary and wage payments.

And if you’re looking for a complete online payroll solution, Xero seamlessly integrates with other third-party HR and payroll software. This includes Rippling, Deel, Oyster and TemboPay, to name a few.

QuickBooks Payroll Management

One of the standout features of QuickBooks payroll management is its tax penalty protection. For example, in the United States, if your business incurs a penalty due to a payroll tax error, QuickBooks will cover the cost of up to US$25,000. This gives you peace of mind, especially for small business owners who might not have the resources to deal with unexpected fines.

When it comes to handling payroll taxes, QuickBooks truly shines. The software automatically calculates, files and pays your payroll taxes with an accuracy guarantee. This automation reduces the risk of human error and saves time.

Other QuickBooks payroll management features also include:

- Workforce apps

- Automatic payroll

- Time tracking for improved accuracy and timesheets

- Seamless integration

What’s more, you can also consult HR advisors to help you stay legally compliant. You can access the latest information on state and federal wage and overtime regulations at no additional cost.

User Experience: Which is Easier to Use?

When selecting accounting software, user experience is an important factor that most business owners and freelancers often overlook. Although QuickBooks and Xero are industry leaders with extensive features, the ease of use and overall experience of these platforms can affect how smoothly a business runs.

Xero vs QuickBooks: Interface and Navigation

Let’s explore how their interfaces and navigation styles can significantly impact your day-to-day operations.

Xero Interface and Navigation

Often praised for its clean, intuitive interface, Xero is designed with user-friendliness in mind. It is organised from a business owner’s point of view, which only gives you three easy-to-navigate categories: Business, Accounting and Contacts.

The Xero dashboard also gives you a clear view of your financial data and business activities, which you can customise to show the information you need. Here’s how:

- Widgets: You can add, remove or rearrange widgets on the dashboard to focus on the data that matters most to you.

- Layouts: Xero offers different layout options to fit various roles and preferences.

This customisation helps you see the most important information right away when you log in.

QuickBooks Interface and Navigation

Unlike Xero, QuickBooks may appear complex since it was designed with accountants in mind. It has over ten categories, each with multiple subcategories. These are arranged on the left pane rather than at the top of the page.

The categories use a left-to-right menu system, which can be more challenging to navigate. Although the categories were recently reorganised, they still seem as confusing—or even more so—compared to the previous setup.

However, QuickBooks offers different accounting tools, providing in-depth financial insights.

Xero vs QuickBooks: Learning Curve

Choosing between Xero and QuickBooks often boils down to their learning curves. How do they differ in this aspect? Let’s discuss.

Xero Learning Curve

Since Xero was built with the assumption that users may not have an accounting background, Xero has a gentler learning curve compared to QuickBooks. Even without extensive training, its focus on ease of use and intuitive design makes it easier for beginners to get up and running quickly.

While it may not offer as many advanced features as QuickBooks, its straightforward approach helps users become proficient faster, making it an appealing choice for small to medium-sized businesses.

QuickBooks Learning Curve

QuickBooks has been around for a long time, and many users are already familiar with its interface. For previous users, the learning curve may be shorter.

However, users new to accounting might find QuickBooks’ interface overwhelming initially. It provides more customisation options and features, which can also increase the time needed to master the software.

While QuickBooks may have a steeper learning curve compared to simpler systems, it offers support resources. Users can access online guides, chat with support agents or speak to someone over the phone. Additionally, specific support hours are available for different subscription levels, with advanced users enjoying 24/7 assistance.

Pricing: Xero vs QuickBooks

Below, we compare the pricing plans for both platforms and they can cater to businesses of different sizes and needs.

QuickBooks Pricing Plans

QuickBooks Online provides four tiers: Simple Start, Essentials, Plus and Advanced. Each plan builds on the previous one, adding more features as you move up the tiers. You can start with a lower-cost plan and upgrade as your company expands and requires more features.

Simple Start

Price: Starts at US$35/month.

Ideal For: Self-employed freelancers, contractors and sole proprietors.

QuickBooks Simple Start caters for solo entrepreneurs. Its accounting tools include income and expense tracking, invoice creation, payment handling, tax deduction claims, receipt collection and mileage tracking. However, it doesn’t include bill payments.

Essentials

Price: Starts at US$65/month.

Ideal For: Small to medium-sized businesses.

Suitable for small businesses, this plan supports up to three users and includes all the features of Simple Start, plus additional functionalities such as tracking hours worked and managing bills.

On-site service businesses will benefit from mileage tracking, invoicing and hourly tracking. These features can significantly streamline operations and reduce administrative workload.

In a nutshell, if your business needs more than the basic accounting functions and can take advantage of features like time tracking and bill payment, QuickBooks Essentials is the appropriate choice.

Plus

Price: Starts at US$65/month.

Ideal For: Mid-sized businesses.

QuickBooks Plus is designed for growing businesses seeking a comprehensive solution for operations.

With features like project management and tax support, it caters to the needs of mid-sized companies. It helps you track project profitability, expenses and labour costs. The plan’s capacity also gives access to up to five people where they can see detailed reports on how projects are going and how profitable they are.

This plan includes a great tool called an inventory tracking system to help you keep track of your products. You can see how much of each item you have and get alerts when you’re running low. It’s easy to see what’s selling well, what to order and manage your suppliers.

You can even send all this information to a spreadsheet or connect directly to online stores like Amazon, Shopify and Etsy.

Advanced

Price: Starts at US$235/month.

Ideal For: Large businesses.

For larger businesses with big accounting teams, the Advanced Plan up to 25 people use the software at once, which is a significant jump from the lower tiers.

It provides business insights and analytics tools unavailable in lower tiers. You can create visual, customisable reports ready for presentation, track financial and non-financial KPIs, and compare benchmarks, clients, and more.

You can also connect to other programs like Salesforce, Hubspot and DocuSign.

Managers can control what people can see and do. You can also back up your data to keep it safe.

QuickBooks will help you get the most out of this plan. You’ll have your team to help you, and your employees can learn how to use the software.

Xero Pricing Plans

Xero also offers a range of pricing plans to accommodate various business sizes.

Early

Price: Starts at US$15/month.

Ideal For: Small business owners with limited transactions.

Early is designed for emerging businesses and sole traders that need fundamental accounting tools. Its intuitive interface makes it accessible to users without extensive financial expertise.

Its key features include:

- Invoicing: Create, send and approve up to 20 professional invoices, plus unlimited quotes.

- Bill Management: Track, schedule and pay up to 5 bills.

- Bank Reconciliation: Effortlessly match bank transactions to records.

- Document Management: Capture and store bills and receipts with Hubdoc integration.

- Cash Flow Forecasting: Gain insights into short-term cash flow with up to 30-day projections.

- Mobile Access: Manage finances on the go with the Xero mobile app.

- Inventory Tracking: Monitor stock levels, and manage orders and bills.

- Reporting: Create and customise financial reports with built-in formulas.

- Payments: Accept online payments swiftly through Stripe, GoCardless and other providers.

Growing

Price: Starts at US$42/month.

Ideal For: Scaling small businesses.

Xero Growing is tailored for expanding businesses that need more advanced financial management. It builds upon the Early plan, offering comprehensive tools to simplify operations and improve financial insights.

It includes everything in the Starter package plus:

- Bulk reconcile transactions: Quickly match multiple transactions to bank statements, especially useful for accounts without bank feeds.

- Unlimited bill pay: Schedule as many bill payments as you need.

Established

Price: Starts at US$78/month.

Ideal For: Established businesses, particularly those handling international transactions.

The Established Plan has features for businesses with complex financial management needs. It includes multi-currency invoicing and payments, expense claims and project management, making it ideal for established companies with more sophisticated requirements.

It includes all the features in Early and Growing plans, plus:

- Multi-currency Support: Handle transactions in multiple currencies for global business operations.

- Project Management: Oversee projects, track time and expenses, and accurately bill clients.

- Expense Claims: Submit and track employee expenses efficiently, minimising manual processes.

- In-depth Analytics: Monitor cash flows, assess your company’s financial health and track key performance indicators with Xero Analytics Plus. Pricing for this upgrade is available directly from Xero.

Value for Money

Determining the best value for money between QuickBooks and Xero depends on the specific needs of your business.

QuickBooks generally offers a more comprehensive feature set across all pricing tiers. It might be a better choice for businesses requiring advanced inventory management, job costing or complex reporting. However, the higher-tier plans can be relatively expensive.

On the other hand, Xero is known for its user-friendly interface and strong focus on cloud-based technology. It might be a more cost-effective option for businesses that don’t require the most advanced features. Additionally, Xero’s unlimited users on all plans can be a significant advantage for larger teams.

We highly recommend visiting QuickBooks and Xero websites for updated pricing information. They may have promotional offers or discounts to help you cut costs.

Xero vs QuickBooks: Pros and Cons

Now that we’ve covered the core features, pricing structures and user experience of QuickBooks and Xero, let’s explore the pros and cons of each platform.

Xero Pros and Cons

Pros

- Cloud-Based Accessibility: Since Xero is a fully cloud-based platform, it allows users to access data from anywhere with an internet connection.

- Intuitive Design: Its user-friendly interface ensures a smooth experience for both accounting experts and beginners. Even if numbers aren’t your thing, you’ll find your way around effortlessly.

- Real-Time Collaboration: With Xero, you can work with your advisors, such as accountants or bookkeepers. You can share financial info in real time and get expert advice when you need it.

- Unlimited Users: Xero offers unlimited user access with all its plans, which is beneficial for businesses with multiple team members needing access to the software.

- Affordable Pricing: Xero’s pricing is generally more competitive. It offers good value for its features compared to some other accounting software options.

Cons

- Pricing Adjustments: Unfortunately, Xero has increased its fees and removed built-in payroll from its plans. Carefully compare the cost to the value offered before choosing a plan!

- Inventory Limitations: Xero’s inventory management features are basic. Businesses with complex inventory needs might require additional tools or apps to complement Xero.

- Missing Debt Collection Tool: Without a built-in system to chase overdue payments, businesses must manage it manually or use third-party tools.

- Feature Restrictions: Access to advanced features like expense claims, projects and multi-currency is limited to Xero’s highest-tier plan.

QuickBooks Pros and Cons

Pros

- Access anywhere, anytime: QuickBooks Online is a cloud-based software, meaning you can access your finances from any device with internet access. No need to install complicated software.

- Affordable and risk-free: QuickBooks offers flexible pricing plans to fit different budgets. Plus, you can try it out for free before committing.

- Comprehensive financial management: From tracking income and expenses to managing payroll and inventory, QuickBooks covers the accounting basics. You can also generate financial reports to understand your business’s health.

- Improved customer relationships: With QuickBooks’ online client portal, you can send invoices, get paid faster and communicate easily with your customers.

- Expand your software’s capabilities: QuickBooks can work with other business tools to streamline your workflow. This flexibility allows you to customise the software to fit your exact needs.

Cons

- Missing key features: QuickBooks may fall short for businesses needing advanced payroll or project management tools. Additionally, it might lack specialised features for specific industries like lot tracking, eCommerce integration and barcode scanning.

- Steep learning curve: Getting the most out of QuickBooks requires a lot of time to learn its ins and outs and tailor it to your business.

- Growth Constraints: QuickBooks can be restrictive for growing businesses due to file size limitations and user caps.

- Scalability Challenges: QuickBooks might become expensive as your business grows, as higher tiers often come with significant price increases.

Xero vs QuickBooks: Which Should You Choose?

If this is your first time choosing accounting software to help you manage your business, choosing between Xero and QuickBooks might feel overwhelming. Both offer features you need, but how do you decide which is the best? How can you ensure your hard-earned money on the right thing?

It’s hard to pick the right winner. Let’s break it down based on the size of your business and your specific industry needs.

Best for Small Businesses

Xero is a great fit for small businesses that prioritise an intuitive platform without needing advanced accounting tools. With its user-friendly interface, transparent pricing, and wide range of integrations, Xero is well-suited for businesses focused on core financial tracking. It offers an affordable entry point that can be scaled as your business grows.

Best For Medium and Large Businesses

QuickBooks is designed for businesses that require a deeper dive into their finances. With advanced features and more customisable options, it’s a solid choice for companies looking to optimise their financial management. Its ability to scale with your business, coupled with time-saving tools, makes QuickBooks a popular option.

Final Thoughts

Regardless of which platform you choose, your final decision will hinge on your business’s unique requirements, financial constraints and desired features.

Always ask yourself questions. What is your budget? Compare the pricing plans of both platforms and consider the additional costs of add-ons or integrations.

What is your level of accounting expertise? If you are new to accounting, Xero’s user-friendly interface might be more appealing. However, if you have more accounting knowledge, QuickBooks’ advanced features might benefit your operations more.

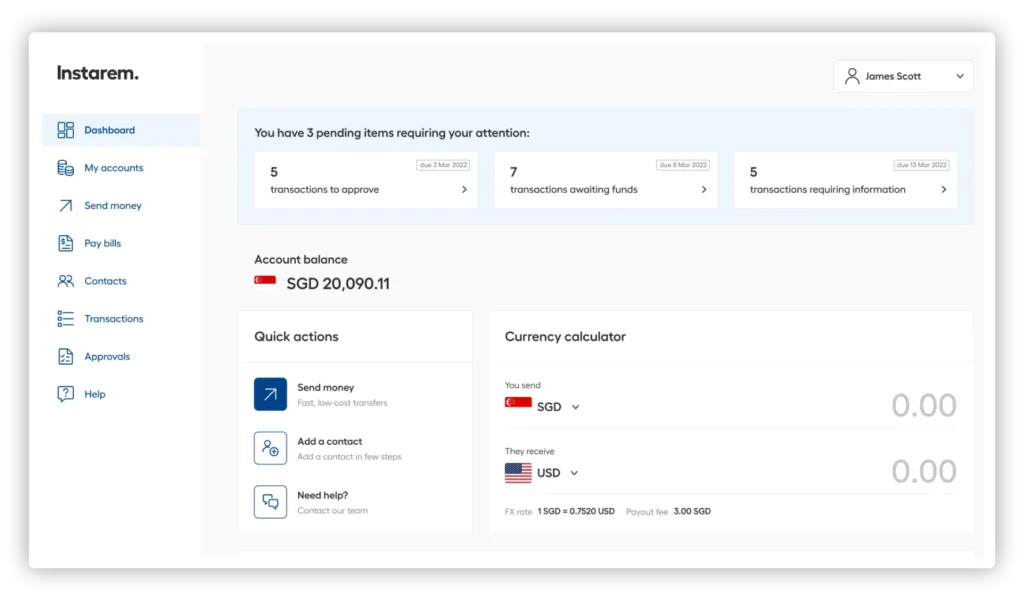

You can also explore payment solutions like Instarem’s business account to complement your accounting software. Instarem can be your ideal first step for managing your finances as you find the right accounting platform.

- Fast Transactions: Up to 12X faster than banks. Most business transactions are completed within the same day.

- International Business Payments: Send and receive payments to your overseas partners and employees in over 160 countries, all at competitive exchange rates and low fees. You can also transfer funds securely and efficiently between your different business locations.

- No Hidden Fees: There are no setup, subscription fees or hidden charges to surprise you.

- Efficient Bulk Payments: Streamline your payment process with our bulk payment feature. Handle up to 1,000 payments at once by simply uploading an Excel file.

- QuickBooks Integration: Simplify your international financial management with Instarem and QuickBooks. Our seamless integration saves you from manual data entry. Access real-time fee tracking, complete transparency and seamless cross-border payments for peace of mind.

Grow your business with Instarem. Sign up now and manage your business finances easier—no matter where you are.

FAQs

Can QuickBooks and Xero handle multi-currency transactions?

Both QuickBooks and Xero can handle multi-currency transactions, but Xero generally offers better features and is more suited for businesses handling international transactions.

Is there a mobile app for QuickBooks and Xero?

Both QuickBooks and Xero provide mobile apps, allowing users to manage their finances, send invoices and track expenses on the go.

Which software offers better integration with other tools?

Yes. QuickBooks and Xero offer integrations with third-party applications, which may differ depending on the country

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with the products or vendors mentioned.