Make international business payments

Pay your overseas suppliers or employees across 160+ countries and save money with great FX rates and low fees.

Why use Instarem

Up to 5X* cheaper than banks

Get competitive, bank-beating exchange rates and low fees.

Up to 12X* faster than banks

Most transactions are completed within the same day.

Secure and reliable

Regulated, licensed, and built on Industry leading technology.

*Based on traditional bank averages. Actual savings and speed vary by amount, destination, currency, individual bank policies, etc.

How you can use Instarem

Salary payments

Pay up to 1,000 employees' salaries in one go, in their local currency.

Supplier payments

Pay your suppliers, vendors and freelancers for goods and services in real-time.

Intra-company transfers

Move money quickly and securely across your business in different locations.

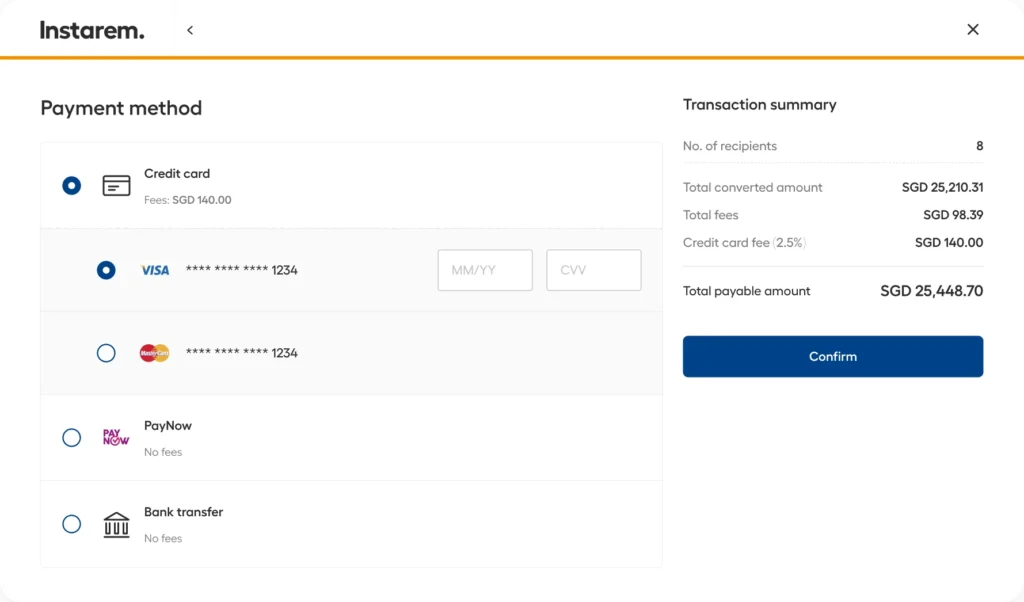

Pay by card, boost your cashflow

Get up to 55 days* of interest-free credit when paying with your Visa or Mastercard bank cards. Continue to earn your card rewards too!

*55-days interest free period is offered by the card-issuing bank (not Instarem) and may vary as per individual bank policies.

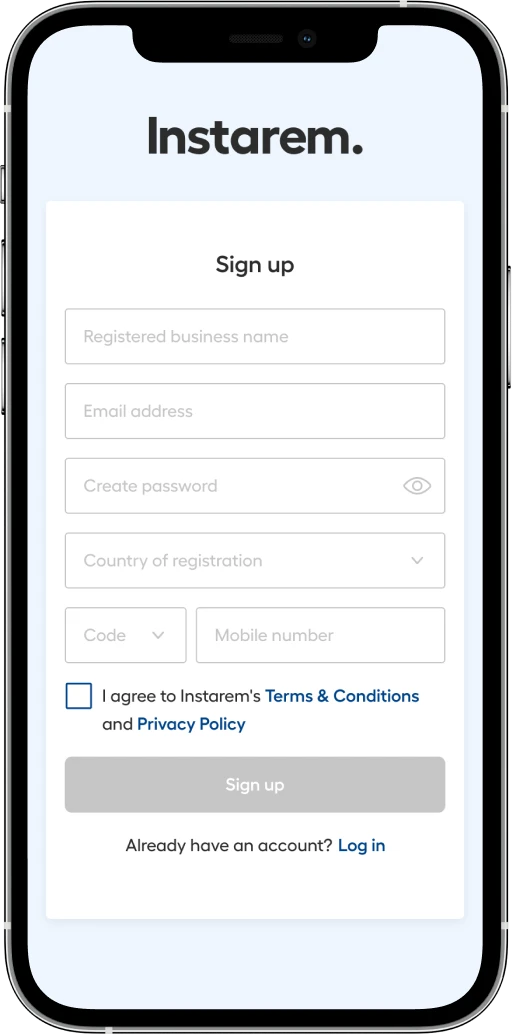

Start making global payments in 3 steps

Sign up

Add your beneficiary

Provide your recipients' details.

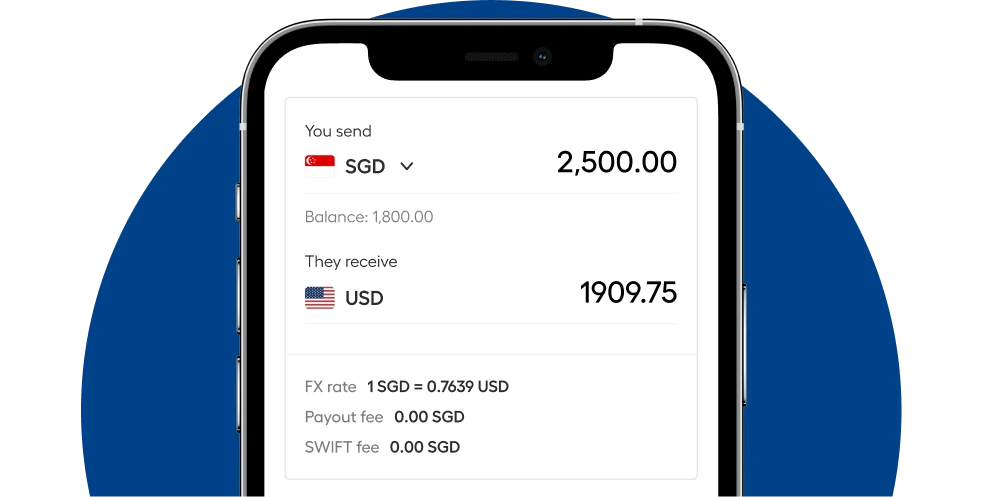

Start transacting

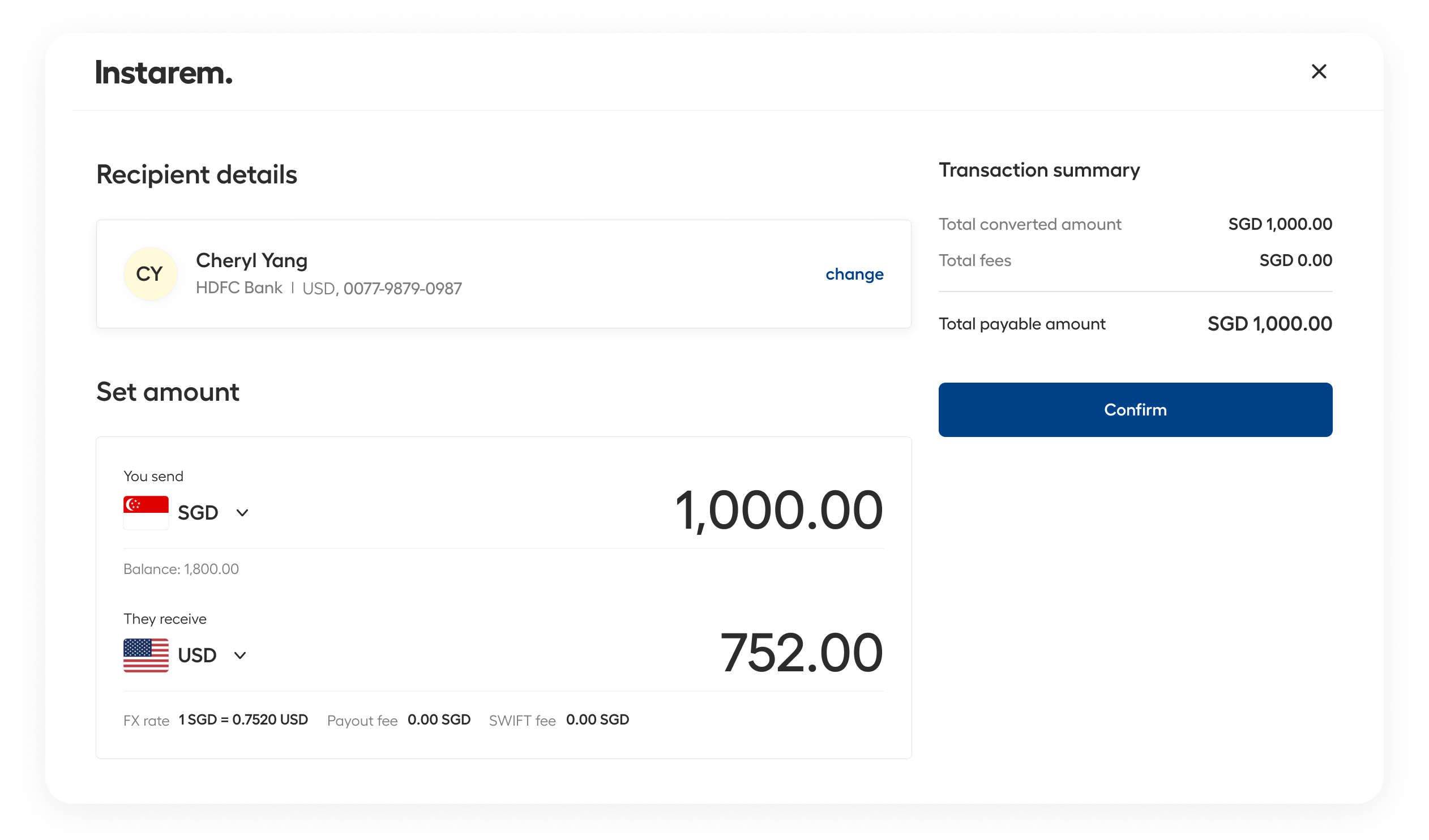

We will show you our best rates and fees upfront before you proceed.

Transparent rates. Low fees. No surprise costs.

What you see is what you pay. Our rates are fair, our fees are low and above all we are transparent, so you see what you are paying for with every transaction.

Exchange rates

Experience exceptional value for your transaction with our industry-leading FX rates.

Fees

Benefit from unparalleled cost savings with our low fees, often up to 5X cheaper than banks.

No extra charges

We don't impose setup or subscription fees, nor are there any hidden charges to surprise you.

How we help businesses

From Friction to Flow: How Aniday Scaled Global Payments with Instarem

Discover how Aniday, an HR tech platform, scaled seamless global payments and streamlined operations with…

How MOBI Asia scaled faster and reduced FX costs by 40% with Instarem

The Company MOBI Asia is a licensed payment gateway operating across Southeast Asia, powering both…

How Lovet improved payment speed and cashflow planning with Instarem

The Company Based in Singapore, Lovet has built a loyal customer base with its focus…

How Instarem supports Airserve Marine Travel’s global operations with faster, smarter cross-border payments

The company Airserve Marine Travel is a regional leader in corporate and marine travel management…

From high fees to high touch: How TRUVI transformed global payments with Instarem

The company TRUVI is a premier luxury travel and lifestyle concierge company specializing in personalized…

From bank delays to borderless speed: How OnlineHKdeal streamlined global reimbursements with Instarem

The Company OnlineHKdeal is a fast-growing e-commerce business that connects global shoppers with…

Ready to grow your business?

Tap into our expertise to streamline your payments, boost your operations, and scale your business.

We are just a click away. Reach out now if you want to hear more.

Explore more

Receive payments

Get paid easily in USD, AUD, SGD, HKD, JPY, NZD, EUR, and GBP without the hefty costs or the need to open local bank accounts.

Blog

Discover how Instarem can transform your business finances – dive into our blog for insights and success stories.

FAQs

To send money as a business from Malaysia using Instarem, follow the steps below:

- Create your Instarem business account: Sign up with your email ID and phone number. To verify your account, you'll need to provide business registration details and information about your Directors and Shareholders.

- Add your beneficiary: After you set up your account, log in and head to the "Contacts" section to add a recipient. Click on "Add recipient," fill in your recipient's details, and save it.

- Initiate a transfer: Go to send money section of your Instarem account. Select the source country and enter the amount you wish to send. We’ll show you the exact exchange rate and any fees upfront.

There may be restrictions on business transfers from Malaysia, which can include limits on transaction amounts, regulatory requirements, and compliance with local and international laws.

It’s best to check with your bank or service provider to understand any specific restrictions or requirements that may apply to your transactions in your country of residence.

No, you cannot transfer funds between your personal and business Instarem accounts. Keeping both accounts separate ensures accurate financial tracking and complies with important regulations for business transactions.