amaze card related fees

Update:

Starting 10 March 2025, the below fee changes have come into effect:

-

- New 1% domestic fee on SGD transactions: A 1% fee (minimum 0.50 SGD) will be applied on all domestic spending when amaze is linked to a debit/credit card. Before, only amounts over 1,000 SGD monthly were charged.

Note:

- The domestic fee applies to all your domestic spending in SGD – including spends that have been refunded, and in some cases, where a merchant puts a temporary hold on your money before a purchase (pre-authorisation).

- To check the domestic fee applied, go to the ‘Activity’ screen on your app and tap on the specific transaction.

- All domestic spending with amaze linked to your wallet will remain fee-free.

- International spending in foreign currencies will not incur this fee.

- 1% MCC fee removed: The 1% MCC fee on payments for MCC 6540 (e-wallet top ups) and MCC 4111 (EZ-Link wallet top-ups and TransitLink General Ticketing Machines only) has been removed.

Note:

- To check the Merchant Category Code (MCC) of your amaze transactions, go to the ‘Activity’ screen on your app and tap on the specific transaction.

- New 1% domestic fee on SGD transactions: A 1% fee (minimum 0.50 SGD) will be applied on all domestic spending when amaze is linked to a debit/credit card. Before, only amounts over 1,000 SGD monthly were charged.

Here’s a summary of amaze fees:

| Annual Fees | Free |

| Card issuance | Free |

| Card replacement and delivery | Free |

| FX (non-SGD) transactions | Free |

| Wallet transactions | Free |

| Linked Card Mode |

Domestic (SGD) transactions: 1% fee (min. 0.50 SGD) FX transactions: Up to 2.1% FX spread (reducing your bank’s FX admin fee of up to 3.5%) Note: There are no fees when you spend via amaze wallet<. |

| amaze wallet top-up with PayNow | Free |

| amaze wallet top-up with Apple Pay | 1.5% fee (minimum 0.50 SGD) |

| amaze wallet top-up with linked bank account | Free |

| Overseas ATM cash withdrawal | 2% fee |

amaze rewards

Update:

Starting 10 March 2025, the following amaze reward changes have come into effect:

- You can earn 0.5 InstaPoint for every 1 SGD spent in domestic or foreign currency when amaze is linked to your wallet.

- You can earn unlimited InstaPoints (no more limit of 500 InstaPoints per month).

- InstaPoints can be redeemed as KrisFlyer miles (1,200 InstaPoints = 400 KrisFlyer miles) or as discounts on overseas money transfers.

- InstaPoints will not be awarded on linked card spends.

- InstaPoints can no longer be redeemed as cashback.

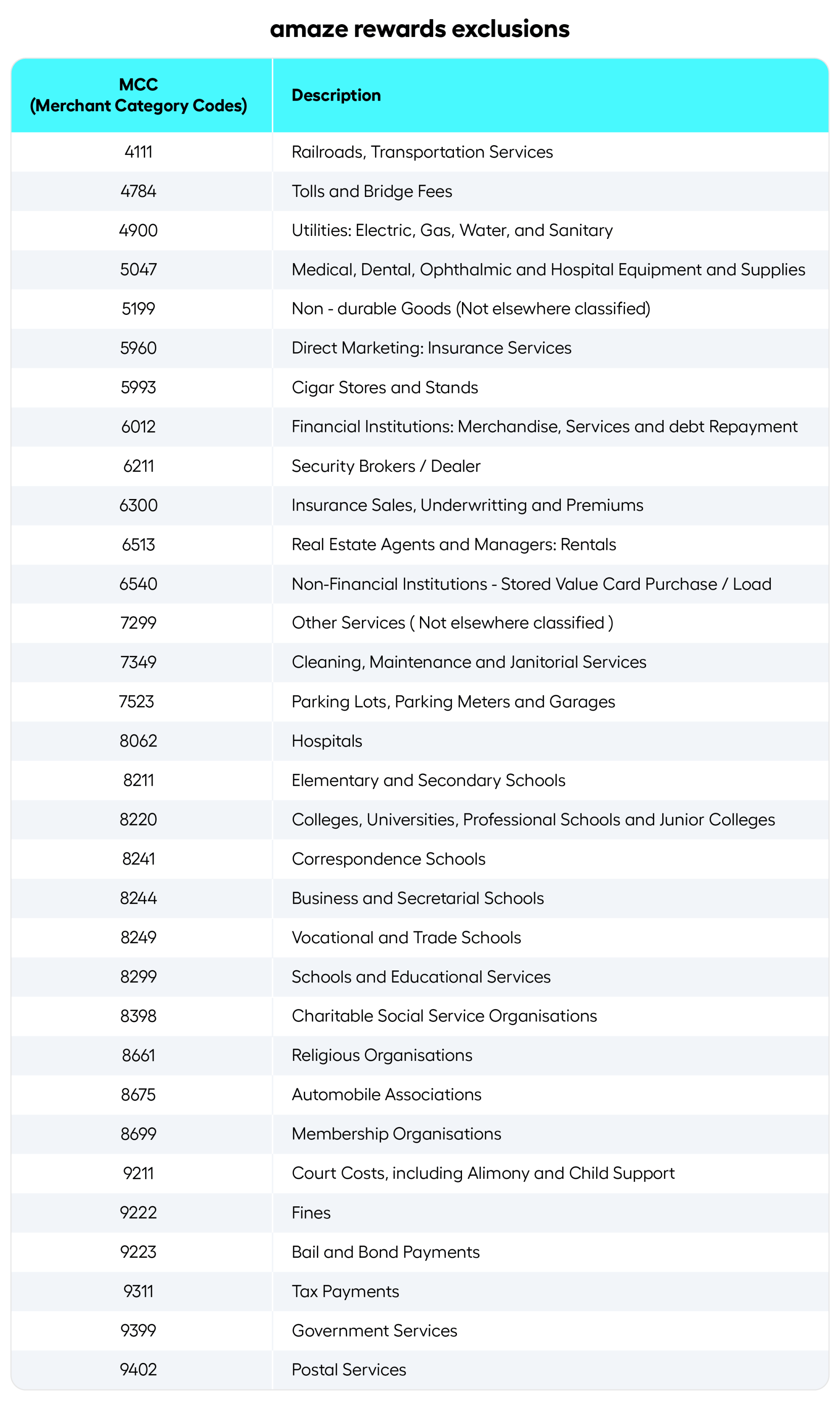

amaze rewards exclusions

amaze payments to the below merchants are excluded from amaze rewards (InstaPoints) eligibility.

However, you can earn unlimited InstaPoints on both domestic and foreign currency spends made through your amaze wallet at all other merchants.

Please note: MCCs are assigned by payment card organisations (e.g. Visa, MasterCard). Instarem does not have a say in the assignation of these codes. A merchant’s registered MCC may not always correspond with its nature of business.