Cost of living in Toronto – single, family & student

This article covers:

- Overview of Cost of living in Toronto

- Do you know?

- A glance at the average cost of living in Toronto

- Average cost of living in Toronto: Single vs Student vs Family

- Cost of living in Toronto as compared to other cities

- Tax scenario in Toronto

- What is a good salary in Toronto?

- What should be your monthly budget to live in Toronto?

- Do’s and don’ts to manage the cost of living in Toronto

- Can’t afford Toronto? Here are the top cost-effective Canadian cities

- Before you go…

- FAQs

Toronto is by far the largest and most populous city in Canada, known for its booming economic and educational sectors. While it offers a modern urban lifestyle and endless opportunities to expatriates, it comes with its own set of financial considerations.

This blog is designed for those planning to move to Toronto and wondering how much is the cost of living in Toronto. We will discuss everything from the total cost of living to tips for managing your expenses in Toronto.

Overview of Cost of living in Toronto

- The cost of living in Toronto for a single person = ~ CAD 3539/month and ~ CAD 42,468/year.

- Toronto living expenses for a family of 4 = ~ CAD 8079/month and ~ CAD 96,948/year.

- The average cost of living in Toronto for students = ~ CAD 1,800/month and ~ CAD 21,600/year.

Do you know?

- According to labour market stats, 82% of the population in Ontario (the province of Toronto) is in full-time employment.[1]

- As per the findings of the Average Salary Survey, the average yearly income in Toronto is CAD 94,592, while the average minimum salary is $62,274 per year. [2]

- With a score of 92.1, Toronto ranks at 11th position in the QS Best Student City Rankings 2024. [3]

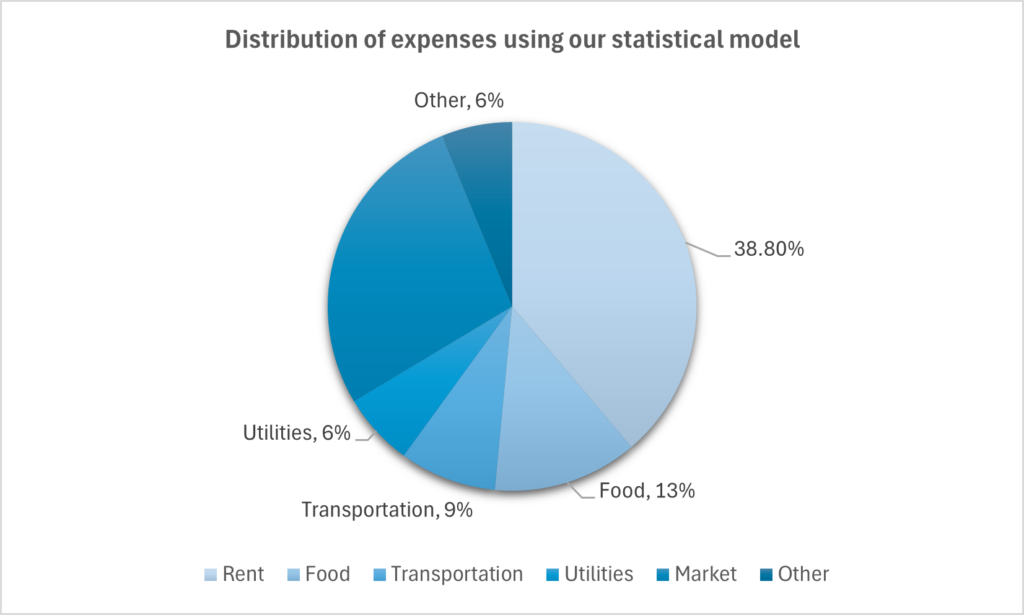

A glance at the average cost of living in Toronto

Source: Numbeo

Average cost of living in Toronto: Single vs Student vs Family

Type of expense | Avg. cost per month for student (CAD) | Avg. cost per month for a single (CAD) | Avg. cost per month for family (CAD) |

Housing & rent | $1,000 – $1,500 | $1878 | $3227 |

Food | $340 | $831 | $2186 |

Transportation | $128.15 | $339 | $864 |

Utility (electricity, water, heating, etc. ) | $80 – $100 | $133 | $209 |

Entertainment | $150 | $150 – $200 | $300 – $400 |

Source: Livingcost.org

Avg. cost of living for students: University of Toronto

An overview of monthly rents in Toronto

Expense Category | Item | Avg. cost per month (CAD) |

Housing | 1-bedroom apartment (in the city centre) | $2248 |

1-bedroom apartment (outside the city centre) | $1878 | |

3-bedroom apartment (in the city centre) | $4089 | |

3-bedroom apartment (outside the city centre) | $3227 |

Source: Livingcost.org

Cost of living in Toronto as compared to other cities

Type of expense | Toronto | Montreal | Ottawa | Calgary | Edmonton |

Monthly Salary (after taxes) | $4689 | $3704 | $4079 | $4736 | $4272 |

Cost of living (single) | $3539 | $2469 | $2950 | $2840 | $2342 |

Cost of living (family) | $8079 | $5820 | $6585 | $6513 | $5132 |

Rent (single) | $1878 | $1067 | $1449 | $1254 | $984 |

Rent (family) | $3227 | $1846 | $2196 | $2077 | $1540 |

Food (single) | $831 | $771 | $796 | $783 | $700 |

Food (family) | $2186 | $2017 | $2085 | $2035 | $1820 |

Transport (single) | $339 | $229 | $243 | $253 | $190 |

Transport (family) | $864 | $602 | $633 | $669 | $497 |

Overall quality of life | 93 | 94 | 90 | 91 | 91 |

Source: Livingcost.org

Note: The above expenses are average costs in CAD

Tax scenario in Toronto

Taxes are an integral part of Canada’s economy. It is crucial to note that the territorial and provincial taxes vary based on the province or territory of your city. Since Toronto comes under the province of Ontario, here are the applicable tax rates for 2024:

Ontario income tax rates for 2024 | |

Tax rate (in %) | Taxable Income threshold (CAD) |

5.05 | up to $51,446, plus |

9.15 | $51,446 up to $102,894, plus |

11.16 | $102,894 up to $150,000, plus |

12.16 | 150,000 up to $220,000, plus |

13.16 | Over $220,000 |

Source: Government of Canada

What is a good salary in Toronto?

As per the Average Salary Survey, the average salary in Toronto is $94,592 per annum. But the real question is, how much exactly do you need to live comfortably in Toronto?

With housing and rental costs rising all around, Toronto is perceived as one of the most expensive cities to live in Canada. The overall cost of living per person is around CAD 3539. So, a monthly salary of at least CAD 4,500 – CAD 5,000 is required to keep up with the Toronto standard of living. This salary will help you cover your necessary expenses such as rent, food, transportation, healthcare, and so on.

Moreover, to live comfortably with family in Toronto, you need at least CAD 10,000 to CAD 12,000 per month. For those living with family, it is recommended to have at least two earning members. In other words, both partners must work to sustain their living expenses in Toronto.

Also read: Average Salary in Canada in 2024 – An Ultimate Guide.

What should be your monthly budget to live in Toronto?

Category | Student | Single | Family |

Housing/Rent | $1,000 -$2,000 | $1,500 – $3,000 | $2,500 – $5,000 |

Utilities | $100 – $150 | $100 – $200 | $200 – $400 |

Groceries | $150 – $300 | $600 – $800 | $1,000 – $2,000 |

Transportation | $100 – $150 | $200 – $300 | $300 – $500 |

Other (entertainment, shopping, personal care) | $100 – $150 | $200 – $300 | $800 – $1000 |

Total##(approximately) | $1,500 – $3,000 | $2,500 – $4,500 | $5,000 – $9,000 |

##It is an approximate value (in CAD) based on the consumer prices and average living expenses of an individual. It is advisable to consider income level, spending habits, location, and specific monthly expenses to calculate an accurate budget.

Do’s and don’ts to manage the cost of living in Toronto

Do’s

- Search for affordable accommodation: As mentioned above, the housing cost in Toronto is skyrocketing due to an acute home shortage. Accommodations, especially those within the city centre, are extremely expensive. If you want to save some money, then consider exploring different areas to find a cost-effective accommodation. Instead of renting out a room or an apartment within the city, check out those outside it. Moreover, if you are a student, then opt out for shared accommodation rather than renting out a separate space.

- Plan a monthly budget: Having a monthly budget is critical to living in an expensive city like Toronto. Without it, you will end up spending thousands of dollars without even realising it. So, create a budget according to your monthly income and expenses and follow it throughout the month. Of course, you can keep your budget flexible, but make sure not to exceed it beyond your financial capabilities.

- Use public transportation: If you are new in the city and haven’t found a good-paying job yet, then avoid buying a car. No doubt it is convenient, but the cost of maintaining a personal vehicle in Toronto is very high. Instead, use public transportation as much as possible. Else, you can also invest in a bicycle to save money on your daily commute.

- Have health insurance: Just like housing and rent, healthcare costs are also increasing furiously in Canada. Even a few minutes of a visit to a hospital/doctor can cost you hundreds of dollars. This is where it becomes important to have a health insurance plan. It can save you from potential medical debts.

- Explore free entertainment options: Instead of looking for paid entertainment options like clubs, cinemas, etc., explore free entertainment activities. There are plenty of free activities in and around Toronto, such as hiking, trekking, camping, attending local festivals, community events, and so on.

- Avoid online shopping: Online shopping is extremely convenient. However, it can lead to unnecessary expenses that can wreck your budget. So, consider shopping in the local markets.

- Consider second-hand options: Buying and selling second-hand products is very common in Toronto. From furniture and appliances to other household items, you can save a lot of money by purchasing used products.

Don’ts

- Ignore CAD to INR exchange rates: Whether you want to send money from Canada to India or vice versa, don’t ignore the currency conversion rates. Use a reliable currency conversion and fund-transfer service like Instarem for safe and secure overseas transfers.

- Rely on eating out: If you want to maximise your savings, then avoid eating out. Instead, buy cheaper groceries from local farmer’s markets and carry out meal prep for the entire week. This way, you will be able to save hundreds of dollars while also maintaining your health and fitness.

- Ignore emergency funds: It is crucial to build an emergency fund when living overseas, as you never know when you might get struck by an emergency. So, save a fixed amount each month and contribute it towards your emergency savings.

Also Read: Top part-time jobs for students in Canada

Can’t afford Toronto? Here are the top cost-effective Canadian cities

- Montreal, Quebec

Montreal boasts a great blend of French and English culture. It features a diverse community with people from every nook and corner of the world living and working together peacefully.

The cost of living in Montreal is reasonable, yet it offers a vibrant and high-quality standard of living. Moreover, the city is home to the prestigious McGill University, one of the most reputed universities in Canada and worldwide.

Average cost of living per person: CAD 2469 per month.

- Ottawa, Ontario

Ottawa is home to two of the most prestigious institutions: Carleton University and the University of Ottawa. With a great education scenario and excellent public and private employment opportunities, it is a great city for students and job seekers alike.

This city offers affordable living costs, mainly in terms of housing. Those looking for a great alternative to Toronto must definitely consider Ottawa.

Average cost of living per person: CAD 2950 per month.

- Waterloo, Ontario: Waterloo is sometimes known as the “Silicon Valley” of Canada for its robust IT and Tech sector.

Not only does it offer world-class education, but it also offers endless opportunities to grow and thrive.

Despite all these benefits, the cost of living in Waterloo is reasonable. Plus, you get a chance to attend exciting tech events and collaborate with entrepreneurs, tech enthusiasts, and academic scholars.

Average cost of living per person: CAD 3026 per month.

- Vancouver, British Columbia

Vancouver is another popular Canadian city among international students and youth professionals.

Located in British Columbia, Vancouver features a lively atmosphere, strong community, diverse neighbourhoods, and magnificent natural beauty.

Although the cost of living in Vancouver is slightly higher than in some other cities, it balances out with good wages and a plethora of free activities.

Average cost of living per person: $3459 per month.

- Calgary, Alberta

Calgary is a perfect mix of urban landscapes and natural beauty. In fact, one of the major benefits of living in Calgary is that you get access to a variety of free outdoor activities like hiking and camping.

Besides, the city is home to the University of Calgary, which is a well-known public research university. For job seekers and fresh graduates, there are plenty of job opportunities across all major sectors, such as IT, finance, sales and marketing, and more.

Overall, it is a friendly city with a relatively lower cost of living than Toronto.

Average cost of living per person: $2840 per month.

Also Read: How to get Canadian citizenship for Indians

Before you go…

Toronto is a great city that offers incredible growth opportunities to international students and professionals. However, managing the cost of living in this Canadian city requires mindful budgeting and making informed decisions. Finding cost-effective accommodation and building a realistic budget are two of the most critical steps. Following the above-mentioned cost-saving tips will help you live in this vibrant city without facing any financial struggles.

When it comes to transferring money overseas, trusted fund-transfer services like Instarem come in very handy. So for example, whenever you need to send money to India from Canada (or Canada to India), consider Instarem. Instarem is known for offering fast** and cost-efficient international money transfer services at competitive currency exchange rates. From no hidden charges to a secure and transparent fund transfer channel, there are various ways in which it can help you.

Try Instarem for your next transfer.

Download the app or sign up here.

Moreover, the mobile application is highly convenient, and you get a chance to earn InstaPoints on frequent transfers, which can be redeemed to avail extra discounts on future transactions.

FAQs

Q. Is it expensive to live in Toronto?

Yes. Toronto is an expensive city to live in Canada, especially in terms of housing and rent. But those with an above-average income can easily survive and thrive in the city.

Q. How much money do you need to live in Toronto?

A monthly salary between CAD 4,000 to CAD 5,000 is required to meet the living expenses in Toronto. This is the bare minimum. So, if you want to live comfortably and generate wealth, then you should aim for at least CAD 90,000 to CAD 100,000 per year. Also, check out our blog on the average salary in Canada.

Q. How much does it cost to live in Toronto for International students?

An international student requires at least CAD 1,500 to CAD 2,000 per month to live in Toronto. Fortunately, there are ample part-time job opportunities available for international students to manage their living expenses.

Q. What is the average room rent in Toronto?

The average room rent varies based on the location, amenities, and other factors. It is around CAD 800 to CAD 1,250 per month. This is in the case of a shared apartment. A single-bedroom flat, on the other hand, can cost between CAD 1,800 to CAD 2,600 per month.

Q. How much is the cost of living in Toronto for a couple?

The cost of living in Toronto for a couple can range between CAD 4,000 to CAD 6,000 per month, including rent and other monthly expenses.

Q. What is the cost of living in Toronto for a single person?

The average cost of living in Toronto for a single person is around CAD 3539 per month, including rent and other major expenses.

Q. What is the cost of living in Toronto for a family?

The cost of living in Toronto for a family is approximately CAD 8079 per month. Nevertheless, it can vary depending on the size of the family, spending habits, and individual expenses.

Disclaimer:

- This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

- Prices mentioned in this blog are subject to change.

- ** Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

- # When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Citations:

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.