- Home

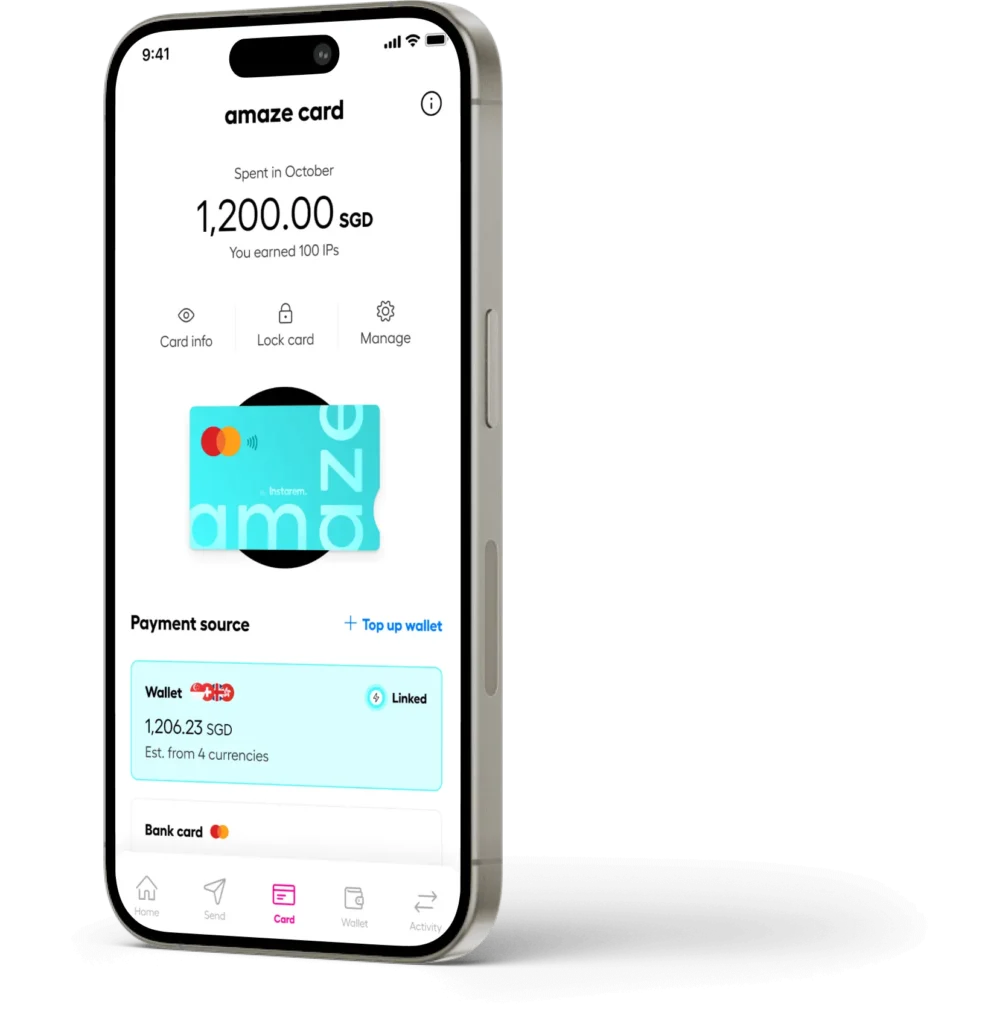

- amaze card

Why choose amaze card

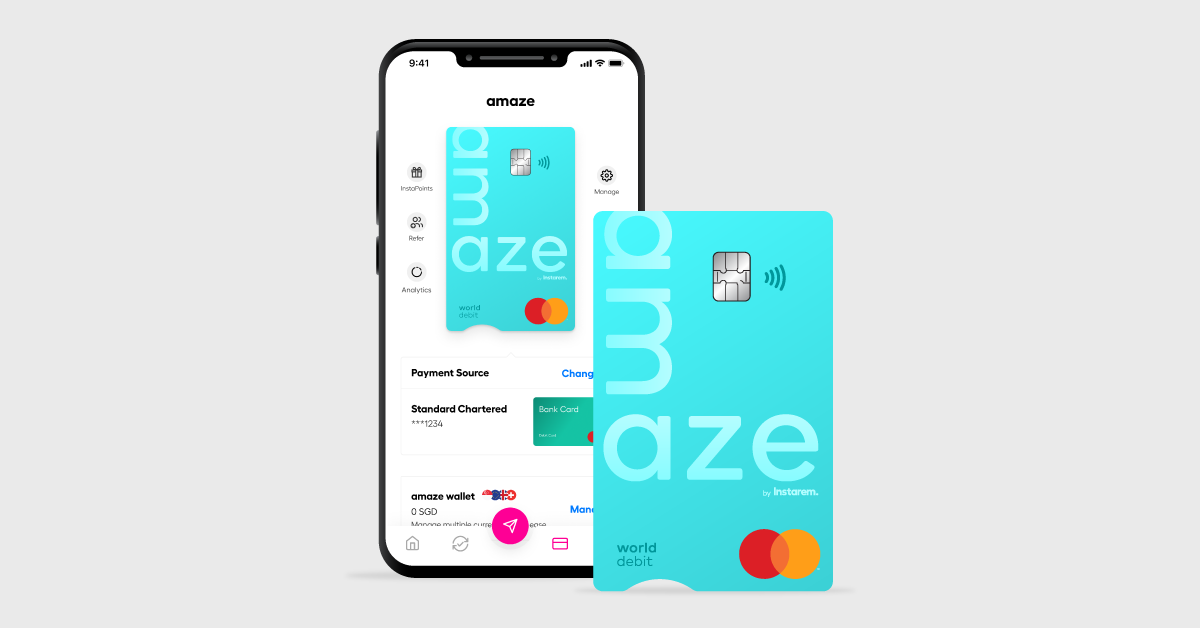

Unlock savings, rewards and convenience when you travel with our amaze card. Get superior foreign currency rates, earn KrisFlyer miles* on amaze wallet spend, and experience the ultimate convenience with a single card!

Save on foreign exchange

Say ‘see ya’ to those unfair bank markups and sneaky admin fees. Pay with favourable exchange rates and keep more cash in your pocket.

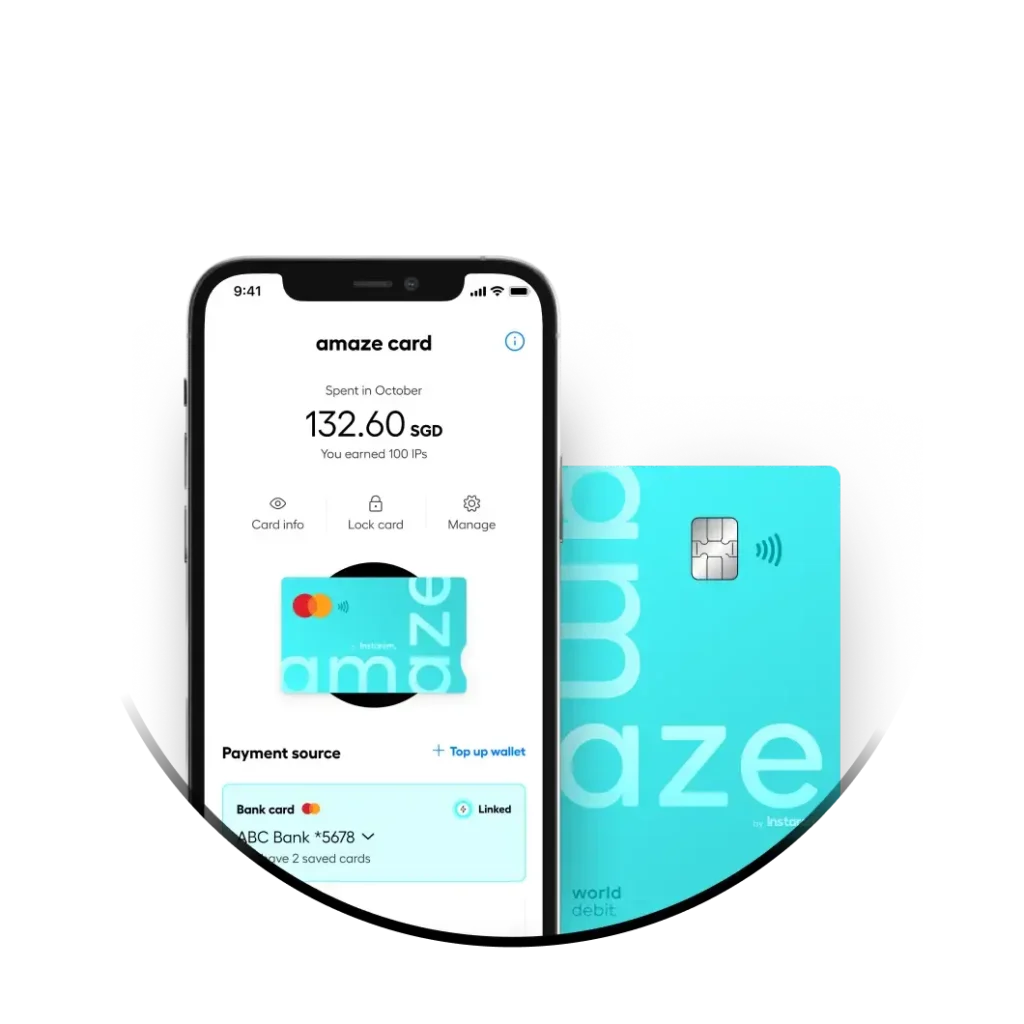

Enjoy ultimate convenience

Top up your amaze wallet or link your amaze card to a Mastercard, Apple Pay, or Google Pay. No more fussing around with multiple payment methods – just one card to rule them all.

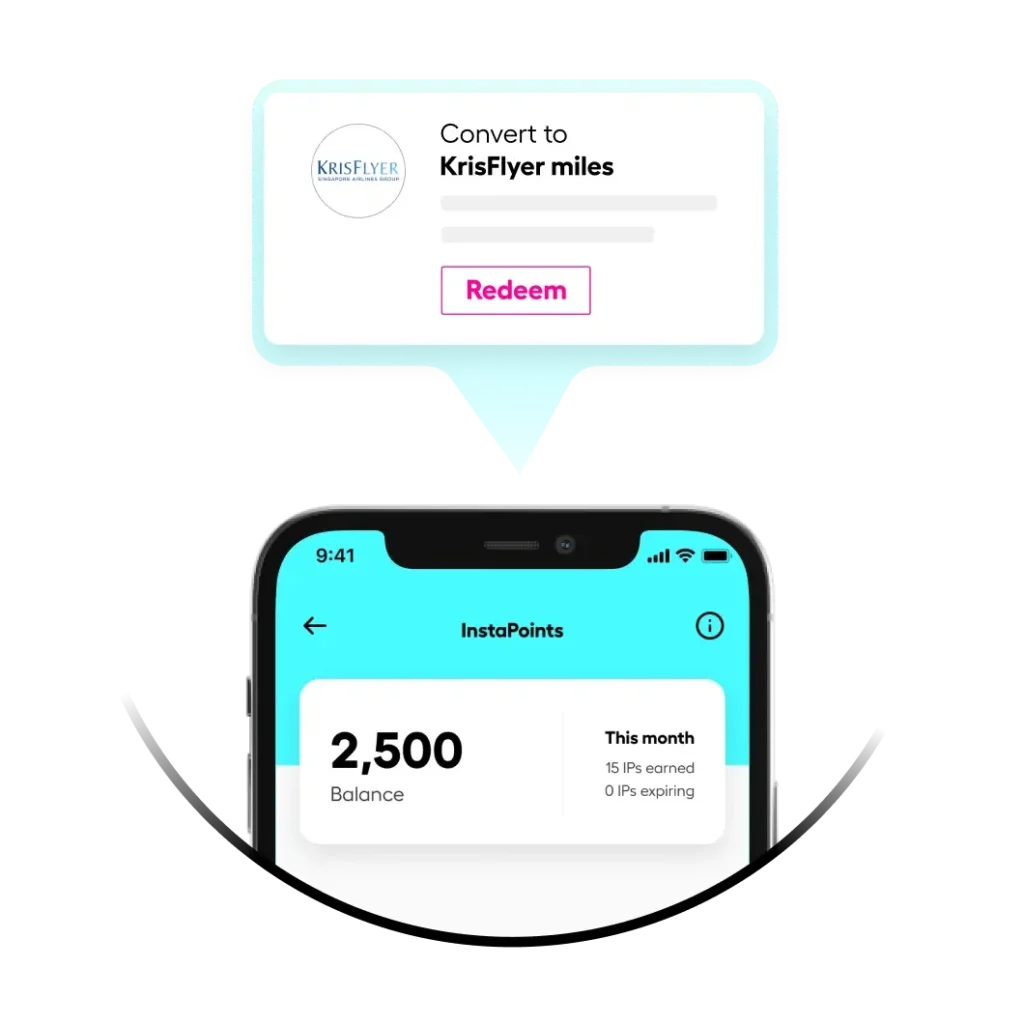

Redeem major rewards

Convert InstaPoints into KrisFlyer miles for flight redemptions or upgrades.

1,200 InstaPoints = 400 KrisFlyer miles.

Stack up on rewards

Say goodbye to bulky wallets with multiple cards. Just carry amaze and start stacking up on awesome rewards and enjoying the perks of travel without the hassle.

InstaPoints

Get 0.5 InstaPoint for every 1 SGD spent locally or overseas with amaze linked to your wallet.

Convert InstaPoints into KrisFlyer miles for flight redemptions or upgrades. You can also redeem the points as discounts on overseas money transfers.

Mastercard benefits

Up to USD 100,000 travel medical insurance. Learn more

700+ offers and benefits on shopping, dining, entertainment and travel. Learn more

No fees, just smooth travels

amaze is built to save you money, not charge you for it.

There are no annual fees, no admin fees, and no hidden FX markups when you spend in foreign currencies with the amaze wallet.

Spending with amaze linked to a card? Domestic transactions incur a small 1% fee, and FX transactions incur up to 2.1% FX spread, reducing your bank’s FX admin fee of up to 3.5%.

Ways to use amaze

Pay and save

Enjoy great foreign currency rates and pay like a local overseas, or when you shop overseas online.

Withdraw cash overseas

Top up your amaze wallet and withdraw up to 1,000 SGD daily at any ATM overseas.

Exchange currencies anytime

Lock the best rates to exchange, store and spend multi-currencies at your convenience.

Download the Instarem app and register for an account if you don’t have one already.

Start using your virtual card or wallet while waiting for your physical card.

Explore more

amaze rewards

Browse our latest promotions on travel, shopping, dining and more with our amaze rewards.

KrisFlyer miles

Convert InstaPoints to KrisFlyer miles on your app (1,200 InstaPoints = 400 miles).

T&Cs apply.

FAQs

The amaze card is a multi-currency travel wallet with 0 FX fees, 0 FX markup, and unlimited rewards.

It is both a virtual and physical card to which you can link up to 5 Mastercard debit or credit cards. This eliminates the need for you to carry multiple cards. You can choose a specific card from your app to transact with any time.

If you don’t wish to link a card to amaze, you can choose to top up your amaze wallet with PayNow, Apple Pay, or your linked bank account, and use your virtual wallet to fund your amaze transactions.

You can apply for an amaze card via the Instarem app. You'll need to have a registered and approved Instarem account to get the amaze card.

Once you have received your physical card via mail, you can activate it through the amaze app.

- Access the amaze page either via the card symbol on the bottom right or via the dashboard.

- Tap on Activate Card.

- Set your Card Pin.

Please note that you can begin online transactions even before your physical card arrives.

You can earn rewards in the form of InstaPoints on amaze wallet spend. You get 0.5 InstaPoint for every 1 SGD spent in domestic or foreign currency with amaze linked to your wallet. The InstaPoint is rounded down to the nearest Singapore dollar. For example, if you spent a total of 1,000 SGD, you will earn 500 InstaPoints. There is no limit on the number of InstaPoints you can earn.

You will receive the InstaPoints within 3 business days upon a successful transaction.

You can convert your InstaPoints to KrisFlyer miles (1,200 InstaPoints = 400 KrisFlyer miles) or redeem the points for discounts on your overseas money transfers.

Please note:

- Foreign currency transactions less than 10 SGD (or foreign currency equivalent), refunds, chargebacks, and transactions in selected Merchant Category Codes (MCCs) are excluded from earning InstaPoints.

- Refunded transactions will be deducted from the relevant bill amount taken into consideration for the computation and awarding of InstaPoints.

- MCCs are assigned by payment card organisations (e.g.: Visa, MasterCard). Instarem does not have a say in the assignation of these codes. A merchant’s registered MCC may not always correspond with its nature of business.

You can easily convert your InstaPoints to KrisFlyer miles on your app. Here’s how:

- Log into your Instarem app, go to InstaPoints and tap 'Convert to KrisFlyer miles'.

- Choose how many miles you'd like.

- Enter your KrisFlyer account details.

- Pay a small admin fee.

The miles will be credited to your account instantly!

You can use InstaPoints to redeem rewards on the Instarem app such as:

- KrisFlyer miles that you can use for flight redemptions or upgrade (1,200 InstaPoints = 400 KrisFlyer miles).

- Discount vouchers for Instarem money transfers.

Authorising your amaze card transactions is an essential step to keep your payments secure. It adds an extra layer of protection against fraud, ensuring that only you can approve your transactions.

You can easily authorise your amaze transactions using your card PIN when you make in-store purchases, and directly via your Instarem app when you make online purchases. This verification step reduces the risk of fraud and gives you peace of mind every time you shop with amaze.

It’s quick and simple.

- For in-store transactions: Authorise using your card PIN.

- For online transactions: You’ll receive a mobile notification – just tap it to approve your transaction directly through the Instarem app.

If you missed the notification, follow these steps to approve:

- Log into your Instarem app and go to Card.

- Scroll down and tap the authorisation banner.

- Click ‘Authorise’.

And with that, you’re all set to shop securely with amaze.

The amaze card can be used anywhere that Mastercard is accepted and in their accepted currencies.

amaze offers competitive FX rates, unlike banks which typically add a substantial markup and FX admin fee.

Thus, you get the best possible value for your FX transactions. Additionally, with amaze, you earn InstaPoints on your FX spends, which can be converted to cashback or used as discounts on overseas money transfers.

Maximum spending limit via linked Mastercard:

- SGD 50,000 per transaction or your linked bank card’s credit limit, whichever is lower.

Maximum spending limit via amaze wallet:

- Daily: as specified in the Instarem app.

- Annually: 75,000 SGD per calendar year.

Unlike traditional banks that charge a significant markup and FX admin fee, amaze offers competitive FX rates to provide you with the best possible value for your FX transactions. Additionally, with amaze, you earn InstaPoints on your FX spends, which can be converted to cashback or used as discounts on overseas money transfers.

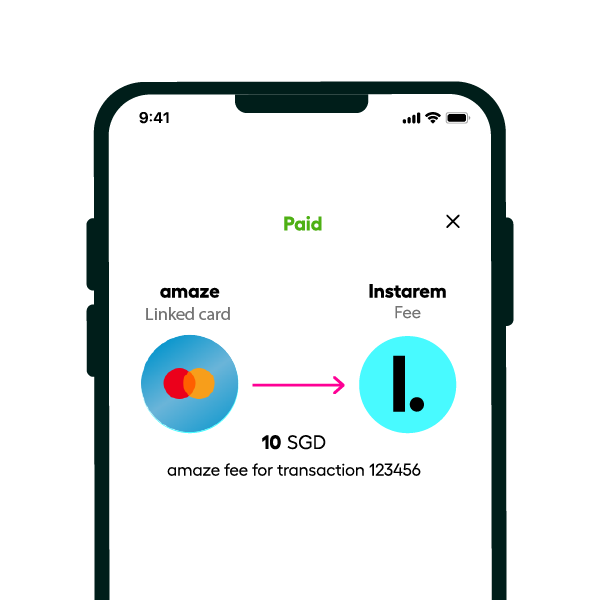

There is no annual fee or admin fee involved with the amaze card. There are also no fees involved when you make any foreign currency transactions with amaze.

However, when amaze is linked to a debit/credit card, domestic transactions incur a small 1% fee – and FX transactions incur up to 2.1% FX spread, reducing your bank’s FX admin fee of up to 3.5%. Domestic and foreign currency transactions made via amaze wallet are fee-free.

Also, there’s a fee for withdrawing money with your amaze card overseas.

Here is the breakdown of all the fees associated with amaze:

Domestic (SGD) transactions: 1% fee (min. 0.50 SGD)

FX transactions: Up to 2.1% FX spread (reducing your bank’s FX admin fee of up to 3.5%)

Note: There are no fees when you spend via amaze wallet.

While foreign currency transactions are completely fee-free, there’s a small 1% fee on domestic transactions (minimum 0.50 SGD) when amaze is linked to your debit/credit card. This helps ensure that we can continue offering you the best travel card experience and competitive foreign exchange rates while managing other costs.

You can view all the fee details here.

| amaze transaction | Domestic fee charged | |

| amaze linked to card | amaze linked to wallet | |

| 20 SGD for MRT fare | 0.50 SGD | No fee |

| 300 SGD on NTUC | 3 SGD | No fee |

| 1,500 SGD on UNIQLO | 15 SGD | No fee |

Exchange rates and applicable FX fees are available in-app after you initiate a transaction.

If you have signed up with Instarem using eKYC (electronic KYC), there are no documents required, as the necessary data is extracted from MyInfo.

However, for manual KYC (where you have not used MyInfo), you will need to submit Proof of Identity in the form of your passport or national ID, as well as Proof of Address.

You can link up to 5 Mastercard (debit or credit) cards that have been issued in Singapore.

The amaze wallet is a virtual wallet that you can use to fund your amaze card transactions. Simply top up your wallet using PayNow, Apple Pay, or linked bank account, and select it as the primary payment source in your app.

You can also spend, exchange and withdraw multiple currencies through amaze wallet.

You can top up your amaze wallet instantly with Apple Pay on any iOS mobile device running iOS 16.2 and above. Just follow these simple steps:

- Log into Instarem app, go to Wallet and click on Top up.

- Select Apple Pay as the top up method.

- Enter the amount and click on Top up with Apple Pay.

- Follow the on-screen steps and confirm your payment.

Once you’ve set it up once, you can top up via Apple Pay anytime - fast and secure, without leaving the app.

Note: Your Apple Pay must be linked to a Visa or Mastercard debit card issued in Singapore (international cards are not supported). Ensure your card has sufficient balance before topping up.

Currently, credit card top ups are unavailable. Please use a Visa or Mastercard debit card issued in Singapore.

No, there’s no fee for topping up your amaze wallet.

Spending via amaze wallet:

- The amaze wallet can hold up to the maximum amount specified within the Instarem app in one day, with an annual spending limit of 75,000 SGD per calendar year.

- Entitles you to earn InstaPoints on both, domestic and foreign currency spend. You can convert the points to KrisFlyer miles on your app or use them as discounts on money transfers.

- Domestic and foreign currency spends via amaze wallet are fee-free.

Spending via amaze linked to a Mastercard credit or debit card:

- The per transaction spending limit is 50,000 SGD or equivalent. It is also subject to the linked card's respective card issuer limit, whichever is lower.

- Does not earn you InstaPoints. You may earn rewards (if any) by your card issuing bank, subject to the bank’s terms and conditions.

- Domestic spends via linked card are subject to a 1% domestic fee (minimum 0.50 SGD).

The minimum top up required to use your amaze wallet is 1 SGD. You can top up your wallet for any amount which does not cause your wallet to go over the amount specified in the Instarem app.

Yes, starting 10 March 2025, you can withdraw your SGD balance from your amaze wallet to your bank account. If you have any foreign currency balance, you can convert it to SGD first and then withdraw it.

Please send your account closure request to our customer experience team via our Help Centre in the app. Our team will assist you promptly.

If you have chosen your amaze wallet as the payment source for amaze transactions and the balance is insufficient, your transaction will be declined. Please top up your wallet to make your transaction.

In some instances, your balance may drop below SGD 0 due to a number of reasons (but not limited to) such as:

- Recurring payments

- Delayed processing by the merchant

- Unauthorised transaction

In cases of unauthorised transactions, please lock your card immediately and report the transaction by following these steps:

- Open your app and click on the second button (activity icon) on the bottom right.

- Click on the specific transaction under transaction summary.

- Click on Report a problem.

- Alternatively, go to Help Centre in the app to chat with us or submit an enquiry. Our customer service team will require you to complete a dispute form within 14 days from the date of the unauthorised transaction.

In other cases, please go ahead and top up your wallet to balance out the negative amount and to avoid any issue of overdue payments

No, as you did not spend through your linked card. However, you will still be eligible to receive InstaPoints on domestic and foreign currency spends made through your wallet.

You can use your amaze card to make international payments through your linked debit/credit card or amaze wallet.

If you’d like to send money overseas, use the Instarem app and transfer money via PayNow, bank transfer or cards.

Yes, you can add your amaze card to Apple Pay. If you’re waiting for your physical amaze card to arrive, you can add your virtual amaze card to Apple Pay and get started with easy contactless payments. Learn more here.

You can transact in any currency and use the amaze card anywhere that Mastercard is accepted, in the currencies that they support.

You can top up your wallet with SGD only. However, you may convert SGD to EUR, USD, JPY, THB, GBP, AUD, CHF, NZD, CAD and MYR. In total, your wallet can hold up to 11 currencies.

Any balance you hold in the relevant transaction currency will automatically be debited first, to minimise your conversion costs (e.g., if you are making a payment in Europe, your EUR balance will be debited by default). If you do not hold any balance in the relevant transaction currency, or the balance you hold in the relevant currency is insufficient, your balance held in other currencies will be debited, starting from your SGD balance, followed by EUR, USD, JPY, THB, GBP, AUD, CHF, NZD, CAD and MYR, in this order.

If the transaction currency is a currency other than SGD, EUR, USD, JPY, THB, GBP, AUD, CHF, NZD, CAD and MYR, your SGD balance will be used to make the payment. If your SGD balance is insufficient, your balance held in other currencies will be converted to SGD to make the payment, in the following order: EUR, USD, JPY, THB, GBP, AUD, CHF, NZD, CAD and MYR.

Example 1

- Wallet balance: SGD 100, EUR 100, GBP 100

- Amount payable: EUR 80

- Amount charged: EUR 80

- New wallet balance: SGD 100, EUR 20, GBP 100

In your transaction history, you will see one row for the payment of EUR 80.

Example 2

- Wallet balance: SGD 100, EUR 100, GBP 100

- Amount payable: EUR 120

- Amount charged: EUR 100 + EUR 20 (converted from SGD 30)

- New wallet balance: SGD 70, EUR 0, GBP 100

In your transaction history, you will see two rows - one for the conversion of SGD 30 to EUR 20, and one for the payment of EUR 120.

Example 3

- Wallet balance: SGD 100, EUR 100, GBP 100

- Amount payable: EUR 200

- Amount charged: EUR 100 + EUR 70(converted from SGD 100) + EUR 30(converted from GBP 25)

- New wallet balance: SGD 0, EUR 0, GBP 75

In your transaction history, you will see three rows - two for the conversion of SGD 100 to EUR 70 and GBP 25 to EUR 30, and one for the payment of EUR 200.

Example 4

- Wallet balance: SGD 100, EUR 100, GBP 100

- Amount payable: EUR 400

- Amount charged: As the sum of all 3 currencies is lower than the payable amount, the transaction will be declined.

In your transaction history, you will see one row - payment of EUR 400 to merchant declined.

Example 5

- Wallet balance: SGD 100, EUR 100, GBP 100

- Amount payable: USD 250

- Amount charged: SGD 340 (the equivalent of USD 250)

- New wallet balance: SGD 0, EUR 0, GBP 40

In your transaction history, you will see 3 rows - two for the conversion of EUR 100 into SGD 145 and GBP 60 into SGD 95, and one for the payment of SGD 340.

No, you may only link one payment source (i.e., either the amaze wallet or a credit/debit card) at any given time. If your payment source is the amaze wallet, and there is insufficient balance in the amaze wallet, the transaction will be declined.

You are eligible to earn InstaPoints on transactions paid with the foreign currency balance in your amaze wallet – in accordance with the amaze Terms and Conditions and the Instarem InstaPoints Policy.

In case of a reversal for any reason (including any successful refunds and chargebacks), the amount credited back to your amaze wallet will be in the same currency that the payment was made. For example, if the payment was made in EUR, the reversal will be performed in EUR. Such reversed transactions are also not eligible to earn InstaPoints. Any InstaPoints that have been credited to you for a transaction that is later reversed will be deducted.

You can hold up to 15,000 SGD (or foreign currency equivalent) in your amaze wallet. You can top up with any amount which does not cause your wallet to go over this limit.

Any excess funds will not be reflected in your amaze wallet and will be transferred to a personal bank account in your name, depending on the currencies that you hold in your amaze wallet, in the following order: SGD, EUR, USD, JPY, THB, GBP, AUD, CHF, NZD, CAD and MYR. You will need to provide us with your bank account details for the transfer.

A settlement amount may apply when making payments or withdrawals in non-pocket currencies (i.e., currencies other than SGD/EUR/GBP/CHF), if there has been a fluctuation of the FX rate between the time of your payment or withdrawal and the time of the merchant’s settlement. This may be reflected as a debited from, or a credit to, the currency pocket from which the payment was made.

Refunds will be credited to your original transacted card. However, in certain cases, the refund amount may be credited to the default linked card or the amaze wallet. Please note that this fully depends on the merchant.

At times, merchants process your card payments in a way that creates a duplicate transaction. Merchants will usually refund the duplicate transactions in 8-14 days and the amount will be returned to you automatically.

If 14 days have passed and the duplicate transaction has not been refunded, please submit an enquiry by logging into Help Centre on web or app. Our customer experience team will get back to you.

When you spend via amaze linked to your Mastercard credit/debit card, you are eligible for any rewards given by your card issuing bank, subject to the bank’s terms and conditions. You may wish to check with your bank prior to your purchase.

However, starting 10 March 2025, InstaPoints are not awarded on linked card spends.

There’s no cap – you can earn unlimited InstaPoints on eligible domestic and foreign currency transactions made through your amaze wallet.

Yes, all InstaPoints issued 1st October 2022 onwards will have an expiry of 12 months from the date of issue. For example, if you received your InstaPoints on 15th October 2022, they will expire on 14th October 2023.

All InstaPoints issued before 1st October 2022 have an expiry of 6 months.

Yes, we are planning to introduce more reward options to you. Stay tuned!

A Merchant Category Code (MCC) is a four-digit number assigned to a merchant or business by the merchant’s acquiring bank, and amaze does not determine the merchant’s MCC. To find the MCC of your transaction, simply go to the ‘Activity’ tab on your app and tap on the specific transaction.

Amaze transactions will start with an AMAZE* prefix. For example, AMAZE* AMAZON.COM.

The safety of your transactions is of utmost importance to us. We ensure that your payments are made to the intended receiver safely, securely, and in accordance with regulatory requirements. However, you can follow these tips to further protect your amaze card from fraud:

- Share your card details: This includes your card number, password, code and PIN. If you need to access your card details to make a payment, go to amaze on the Instarem app, click Card info and copy your card details, or refer to your physical card. Always be sure about who you are paying.

- Turn on alerts: Keep your mobile number and email address updated by going to My info in your profile on the app, so you receive alerts for every transaction made through amaze. If you suspect somebody is pretending to be us on email, reach out to our customer support team via chat by clicking Ask Adam.

- Keep a tab on your transaction history: Click on the card icon at the bottom and view your amaze transactions under card activity.

- Never pay anybody unknown: Scammers can pretend to be government organisations or even your loved ones, so always be alert.

If you find an unknown or suspicious transaction through an email alert or card activity, please lock your card by following these steps:

- Go to amaze on the Instarem app and click the card icon at the bottom.

- Click ‘Lock’ on the right. This will prevent any further transactions on your amaze card.

You may then report the transaction by following these steps:

- Open your app and click on the second button (activity icon) on the bottom right.

- Click on the specific transaction under transaction summary.

- Click on Report a problem.

- Alternatively, you may dispute the payment via the app. Go to Help Centre, click on Enquiries and add a new enquiry. Select amaze card related enquiry and raise a dispute within 14 days from the date of the unauthorised transaction.

You can request a replacement and block your existing card, so it does not get misused. Go to amaze on the Instarem app, click the settings icon (Manage) at the top. Click on Replace a card and select the reason as Lost card. Your current card will then be blocked, and you will receive a replacement with new card details almost immediately. Your physical card will arrive in 14-21 days.

As an amaze World Debit Mastercard cardholder, you can enjoy over 700 offers and benefits on shopping, dining, entertainment and travel. Just pay with your amaze card at the participating merchants listed here.

No, there are no fees involved. To enjoy Mastercard Travel Rewards, you simply need to spend with your amaze card at participating merchants online or in-store.

You can browse all the offers and find out more on Mastercard’s website here.

Cash withdrawal using amaze is only available for overseas ATMs. You can use your amaze card to withdraw up to SGD 1,000 (foreign currency equivalent) per day from any overseas ATM that displays the Mastercard®, Maestro® or Cirrus® logo or that accepts Mastercard bank cards.

Cash withdrawal will be available in 150+ currencies at FX rates provided by the ATM operator. amaze charges a fee of 2% of the value of the amount withdrawn (fee-free until 31 December, 2024). Some ATM operators may also levy cash withdrawal fees or impose a minimum withdrawal amount. The maximum daily withdrawal amount of SGD 1,000 is inclusive of all fees associated with the withdrawal.

To use your amaze card at an ATM overseas please ensure that:

- You’ve selected amaze wallet as your payment source on the app.

- You have sufficient funds in your amaze wallet.

- You have enabled ‘Overseas transactions’ and ‘Overseas ATM withdrawal’. To do so, go to amaze on the app and click on ‘Manage’.

You can then use your 6-digit amaze PIN to withdraw cash overseas.

The money is debited from your amaze wallet. Please ensure your amaze card is linked to your amaze wallet and there are sufficient funds in your wallet before withdrawal.

amaze charges a fee of 2% of the value of the amount withdrawn (fee-free until 31 December, 2024). Some ATM providers may levy additional fees, which are usually displayed on the ATM screen.

You can withdraw SGD 1,000 (foreign currency equivalent) per day including all fees associated with the withdrawal.

The SGD 30,000 annual limit for your amaze wallet applies to your ATM withdrawals from the amaze wallet.

For example:

There is no annual fee or admin fee involved with the amaze card. There are also no fees involved when you make any foreign currency transactions with amaze.

However, when amaze is linked to a debit/credit card, domestic transactions incur a small 1% fee – and FX transactions incur up to 2.1% FX spread, reducing your bank’s FX admin fee of up to 3.5%. Domestic and foreign currency transactions made via amaze wallet are fee-free.

Also, there’s a fee for withdrawing money with your amaze card overseas.

Here is the breakdown of all the fees associated with amaze:

Domestic (SGD) transactions: 1% fee (min. 0.50 SGD)

FX transactions: Up to 2.1% FX spread (reducing your bank’s FX admin fee of up to 3.5%)

Note: There are no fees when you spend via amaze wallet.

Yes, it is. We are compliant with the Payment Card Industry Data Security Standards (PCI-DSS) as well as with the Personal Data Protection Act (PDPA). Rest assured that your data, personal and otherwise, is protected at all times.

*Terms & conditions apply

Related blogs

Guide to overseas ATM withdrawal with Instarem’s amaze

So you’re planning a trip overseas and you need to get your hands on some local currency? If that’s the case, then read on – Instarem has you covered!…

Instarem’s amaze wallet – how to apply, top up and benefits

Instarem is changing the game by making the amaze card available to everyone! This smart…

Meet Instarem’s amaze card: its features, benefits, and how you can get one

Singapore’s first smart card is truly a game changer! Say hello to amaze – the…