15 passive income ideas that will help you build real wealth

This article covers:

What is passive income?

Passive income is a stream of income that you earn with very little effort. It’s the holy grail of income because it allows you to make money while you sleep, on vacation, or doing whatever else you fancy. Passive income is generated through assets, such as real estate, stocks, and businesses.

There are many different ways to create passive income. You can invest in assets that will generate passive income for you, or you can create a business that will run on autopilot. There are pros and cons to both methods, but the bottom line is, that passive income is a great way to make wealth.

Why are passive income investments a great way to build wealth?

First, they can provide stability and security. If you have a stream of passive income coming in, you know that you’ll always have some money coming in, even if you lose your job or your business fails. That security can be a lifesaver in tough times.

Second, passive income allows you to scale your business more easily (if you’re an entrepreneur). When your business is primarily dependent on active income (i.e., you have to work for money), it’s hard to grow beyond a certain point. Passive income allows you to continue to bring in income even when you are not actively working.

Third, passive income gives you more freedom and flexibility. When your income is dependent on your job, you’re limited to how much you can earn and how much free time you have. But with passive income, you can control your own schedule and make as much money as you want. This freedom can be very valuable, especially if you want to travel or spend.

Finally, passive income gives you more time to focus on other things in life. There are times when you want to spend time discovering new things in life and you might just be able to do that when you have a passive income.

In short, passive income is important because it provides stability, scalability, and freedom. If you’re looking to build wealth, creating passive income streams should be a key part of your strategy.

You might be interested in: Emergency fund: Why an expat needs one and how to get started

How to get started with passive income?

“The secret of getting ahead is getting started.” Mark Twain

Passive income is a great way to make money while you sleep, or travel, or spend time with your family. It’s a way to set up your life so that you have more options and are in control of your money. But it’s not easy to get started.

There are a few things you need to do in order to create a passive income stream. You need to invest time and effort upfront, put in the work, and then let the income flow in. Here are four steps to getting started:

- Choose the right passive income stream for you.

- Set up your passive income stream.

- Invest time and effort upfront.

- Let the passive income flow in.

You might be interested in: Tips for successful long term investing

How passive income is made?

There are many different ways to create passive income, and here are some passive income ideas:

- Dividend Investing: When you invest in a company that pays dividends, you’ll receive a portion of the company’s profits each quarter. This can add up to a nice chunk of change over time.

- Real Estate: You can purchase a property and rent it out to tenants. The rental income will then come in each month, giving you a nice passive income stream.

- Peer-to-Peer Lending: With this method, you loan money to individuals or businesses and earn interest on the loan. This is a great way to earn money without having to put any of your own money at risk.

- Stocks and Bonds: When you invest in these assets, you’ll receive periodic payments that can provide a nice passive income stream.

- Rent Out Extra Space (Airbnb): If you have extra space in your home, you can rent it out to tenants. This is a great way to earn some extra money each month.

- Start a Blog: Starting a blog is a great way to generate passive income. Once you get the blog up and running, you can start earning money from ads, affiliate marketing, and other sources.

- Create an Online Course: If you have expertise in a particular subject, you can create an online course and earn money each time someone takes it.

- Write an eBook: Writing an eBook is another great way to generate passive income. Once you write the book, it can be sold on Amazon or other online platforms.

- Create/Sell A Product (dropshipping): Dropshipping is a great option because you can create the product and sell it without having to worry about manufacturing or shipping.

- Affiliate Marketing: With affiliate marketing, you promote products and earn a commission each time someone buys through your link. This is a great way to generate passive income if you have a website or blog.

- Create an App or Software: Once you create the app or software, you can sell it on the App Store or other platforms.

- Start a Youtube Channel: You can create videos and earn money from ads, sponsorships, and other sources.

- Sell Photography Online: If you’re a photographer, you can sell your photos online and earn a commission each time someone buys one of your photos.

- Sponsored Posts on Social Media: You can earn money by doing sponsored posts on social media. Companies will pay you to promote their products or services on your page.

- Advertise on Your Car: You can earn money by advertising on your car. Companies will pay you to put their logos or ads on your car.

Passive income is a great way to boost your savings and secure your financial future. These are just a few of the many ways you can generate passive income. As you can see, there are many different options available.

The best way to find the right option for you is to experiment and try different things until you find something that works.

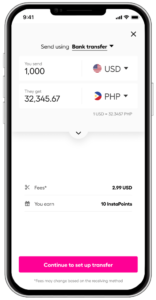

Many of the above ideas can involve handling overseas transactions. Be sure to research any associated fees and taxes to ensure a smooth transaction.

And if you’re not sure where to start, we recommend checking out our guide to foreign currency transfer with Instarem.

*rates are for illustration purposes only.

Instarem offers great rates and a wide variety of currencies, making it a great choice for your needs.

Try Instarem for your next money transfer by downloading the app or sign up here.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.